Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 2

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

The next 18 months will witness M&A volume and valuations that have not been witnessed for nearly a decade. Private equity groups are currently estimated to have nearly $3 trillion in cash ready to conduct deals, which will compete for acquisition targets against traditional corporate teams. Across financial services and banking organizations with prediction of rising rates, the focus will be on shifting from volume to efficiency as the push for widespread straight through processing (STP) of products and services tops priority criteria. A comprehensive disruption of business-as-usual is escalating driven in part by a need to adapt to Industry 4.0 customer demands and behaviors.

A “New” Math is Emerging

However, as consumers demand enhanced experiences residing outside traditional core competencies of FSBOs (e.g., cross border and cross industry), fewer than one in five enterprises are seeking to conduct an M&A that offers innovative or transformative deal results. The focus remains on traditional M&A criteria of scale and market share. So, how will FSBOs become consumer-leading brands when their focus remains on the traditional prescriptions cemented within industry and corporate cultures?

Fueled by data, analytics, machine learning, and even AI, the cross-industry merging of FinTech with traditional FSBO’s will drive acquisitions for Industry 4.0 management teams. However, the prescriptive playbooks once common in seeking out targets, have moved from a positive driver to a negative one as innovation and customers change the math of intra-industry combinations. And after all, how many M&A playbooks ever are measured against customer feedback, consumer behaviors, or even environmental, social, or governance (ESG) criteria dominating purchasing decisions?

In an era now defined by fast-cycle innovation leverage, layers, orchestration, and granular targeting, the new math is 1 + 1 = πx. To attain this “new” math, how will FSBOs deal with the 50% of home sellers cashing out—not seeking a next property—when it comes to M&A targets, products, services, and the emerging, cascading financial impacts that lack familiarity?

For many, these “new” math ideas seem too farfetched, too esoteric, or even too crazy to be taken seriously. That is until you factor in the rise of FinTech firms that exploded in a decade from a few hundred to more than 13,000 by the end of 2021. The rise of RegTech vendors in the same period from single digits to nearly 500. The demise of cross-industry merger barriers once created to ensure corporate focus now viewed as a necessity against non-traditional competition (e.g., many discounted Rocket Mortgage during the last decade). Moreover, let us not fail to anticipate the comprehensive disintermediation of the mortgage markets driven by cross-industry data, ushering in innovative STP vendors and startups, and the growing automation of complex processes improving time and accuracy.

With data now representing the dark matter binding deals and ensuring post-deal leverage, what should be at the forefront of M&A teams is the reality of multi-dimensional solutions, which digitally demand a building block mindset for business processes, IT, and data governance. Yet, traditional transitions used to take years giving ample reactionary time to prepare for and implement M&A demands spurred by long-tail market forces. Today the rise of data as the currency of deals continues to shorten the cycle time for post-deal integrations, while depleting the lasting value of the combined firms (i.e., what have you done for me lately?). What changes to the M&A formulas will be adopted to ensure that the candidate firms and their value is not lost during the assembly of the two entities?

Digital Transformations Were Just the Beginning for Leadership Teams

It was in 2018 when digital transformation as a corporate initiative came into the mainstream. The adoption went from visionary leaders and their firms to competitors seeking to keep in step with those entities viewed as innovative. Prior to 2018, the push toward digitization was billed as an end state—the Holy Grail to eliminate paper and streamline processes. The reality with both is they became the “price of admission” for industry competitors and minimal profit. These two trends are key events that are leading to M&A digital demands and the push to leverage data versus the traditional approaches of integration.

Additionally, for traditional FSBOs and their elite M&A teams, the value equations defined by due diligence has shifted into the post-deal integrations. Moreover, the infrequency of M&A events often ignored the feedback improvements learned from the frequently inaccurate and inefficient integration methods and approaches resulting in employee turnover and lost competitive advantages. With M&A digital demands now at the forefront, visionary leaders are conducting agile sprints of timeboxed requirements to secure positive movement, while leveraging successful transition elements—and jettisoning the failures.

The abridged digital demand categories include the following for every FSBO contemplating or conducting M&A events in a climate of regulatory oversight underpinned by social justice demands.

- Vision, strategy and business value

- Digital breadth

- Data governance

- Data curation

- Building block mentality and ecosystems

- Layers of innovational advancements

- Organization and partner capability

- Organizational maturity

- Execution and results

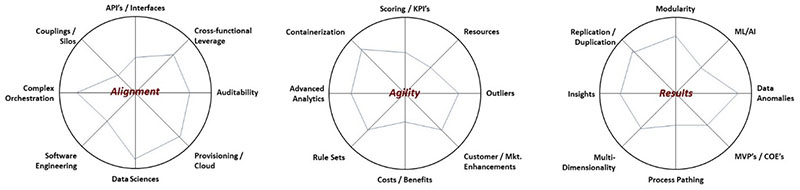

As part of the delivery process for digital demands, enterprises need to create scoring and criteria for not only assessing results, but also determining scope and resources needed to achieve them with the priorities provided. Traditional M&A approaches used financial or operational synergies to produce post-deal successes—but this tunnel vision mindset destroyed investor wealth in over 80% of the integrations undertaken. Below is an illustration of M&A criteria linked to deal categories, but which provide the granularity and flexibility to continually assess progress, while dealing with challenges iteratively rather than at the end of a project.

The Fuel for M&A Fires and Demand for Urgency

As our comprehension of M&A implications expands, we accept that data is the raw, unprocessed fuel of Industry 4.0. Every 28 to 30 months, it doubles in volume from the data previously recorded for all human history. Data not only fuels corporate decisions and digital transformations, but it has also become embedded in customer behaviors and is used to anticipate the needs and demands of markets. As we noted in Part 1 of this series, data is the dark matter that provides the glue to assemble building blocks of innovation, create new functionality across business ecosystems, and have a direct impact on merger and acquisition events not only for targeting, but especially in post-deal integration activities.

Yet data, being abundant as part of a M&A event does not guarantee success—far from it. Data does not ensure financial engineering goals and structures will lead to profitability. Data “V’s”—volume, velocity, validation, value, variety, variability—ensures that prescriptive solutions common in traditional playbooks and mature industries lose their efficacy when applied to emerging delivery and customer models. Moreover, the time demanded for digital integration continues to shorten along with a shift to comprehensive building block mindsets demanded within innovative offerings and from entrepreneurial firms.

Ultimately, those firms that augmented M&A events—integrators, toolset firms, arbitrage players, strategy leaders—are finding that their value to their client “pains” and “gains” are no longer proving to be assets when it comes to pre- and post-deal digital demands. Embracing M&A digital demands requires a shift in the cultural acceptance of deal structures. Why do more than 80% of M&A deals destroy investor wealth? It is a failure to accept that acquisition targets in this era of Industry 4.0 require collaboration, leverage, innovation, and building blocks all linked and “glued” together by data. M&A failures are also driven by a failure to ask questions that are not in the playbooks—to reach beyond what is “the norm.”

Indeed, there is a “next” reality emerging that nullifies the traditional, siloed assistance models underpinning M&A leadership across Industry 4.0 enterprises. Perhaps a few questions might set the stage and move organizational doubts from a framework and into practice.

- The size of M&A deals is increasing along with the frequency of M&A events. Additionally, with the rise of cloud infrastructures and exploding data volumes, how (and why) do you see due diligence, post-deal integrations, or technologies materially altering the traditional drivers of M&A activities?

- Traditional activities for M&A post-deal concentrated on arbitrage, system integration, architectural alignment, and scalability. However, advancing M&A designs now resonate with innovation building blocks, digital transformative ecosystems, and orchestrated leadership in addition to program management, synergy realization, and regulatory compliance management. Where do you see the opportunities when it comes to the emerging M&A digital demands of Industry 4.0 (e.g., soft, cognitive skills offering greater return than hard, toolset skills)?

- Competitive pressures within the M&A delivery landscape range from deal structures to operational strategies to granular integration of products and services. What will be the “next” centers of excellence demanded when it comes to the M&A digital demands brought on by data and evolving client business models? Who will be the MVPs and do they have a reward system that accommodates their risks taken?

- Historically, M&A transactions were defined by a conversion urgency taking place at the traditional pillars of people, processes, and technologies. How do you foresee these pillars evolving against M&A principles and rationale spurring the deals demanding faster response times and low margins of error? Where and with what impacts do you see the often-neglected implications (underpinning the principles and rationale) of the M&A event taking on new importance?

- M&A events are sometimes referred to internally as “a death by a thousand cuts” due to the chaos created across the combining entities. However, when it comes to leveraging innovation across the two firms, what philosophy and methods have you found from experiential results to work more effectively? Where do the greatest return(s) typically reside to leverage innovation to achieve quantum results that neither organization could achieve on their own?

- Across the diverse and growing global enterprises that represent M&A complexities, have your prior M&A events delivered not just in functionality and breadth, but in lessons learned that create phase-shifts for future M&A methods, techniques, technologies, and strategies?

In the end, M&A digital demands require a phase shift in targets, due diligence and even gap analysis. In the end, data is the dark matter force that provides the path forward. In the end, data represents a “new” math that comprehensively remakes the value propositions starting from the targets moving into due diligence and into the post-deal programs. In the end, the iterative demands of data as the M&A fuel in an era defined by unfamiliar investor and consumer drivers require the retirement of traditional playbooks. In the end, M&A digital demands require organizational cultures to “unlearn what you have learned” as the equations have been altered and the “force multipliers” of how to achieve post-deal success begin with data governance and end with the application of machine learning and AI.

M&As are now the reoccurring tip-of-spear for non-organic events which will govern industry advancements for at least for the next 24 months. It will be disintermediation of the FSBO industry that will precipitate the steep rise in M&A events—just look at the PE funds now raised outside of traditional investment bankers cutting out fees and limited value-add. M&A teams that fail to accommodate these FSBO phase shifts will find themselves the targets moving into 2022. To survive M&A teams will need to significantly adjust and seek out new inputs, new frameworks, new personnel, new collaborations, and new math.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)