BREAKING NEWS

Applications Down Again in MBA Weekly Survey

It’s been a familiar pattern for the past month: rising interest rates put a damper on mortgage applications activity for the fourth straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending April 2.

So many people have moved in the past year—either by choice or by circumstance—that it even has its own name: the “Great Reshuffling.”

Cap rates for net lease retail and industrial assets reached record lows during the first quarter as investor demand for these properties reached “historic” levels, reported Boulder Group, Wilmette, Ill.

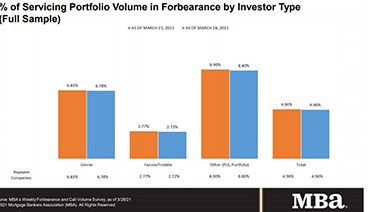

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 4.90% of servicers’ portfolio volume as of March 28 from 4.90% the prior week--the fifth consecutive weekly drop and the lowest level in more than a year. MBA estimates 2.5 million homeowners remain in forbearance plans.

When the full effects of the coronavirus pandemic began hitting in March 2020, the Mortgage Bankers Association quickly realized that life as usual—and business as usual—could take a long time to return to “normal.”

Walker & Dunlop, Bethesda, Md., arranged $55.5 million for Quarry Trails Apartments and Quarry Trails Townhomes and Flats, a 293-unit multifamily and 100-unit townhome project located within a decommissioned quarry in Columbus, Ohio.

As U.S. housing and real estate markets exceed $36 trillion and operating plans continue to reflect growth, the crumbling of the business-as-usual foundations because of big data and innovation acceleration will lead many banking and lending organizations to make the wrong decisions in 2021 by ignoring their customer value across the supply chain.

MISMO’s mission is to develop industry standards to solve real estate finance’s thorniest and most pressing business challenges. To make this happen, we drive collaboration across the mortgage industry and draw participation from all facets of the ecosystem.

Loan officers, branch managers, c-level executives and more need access to granular financial data and in-depth accounting tools in a changing market. The pandemic rapidly spurred the adoption of tech solutions and heightened the industry's reliance on technology – from helping lenders operate, to supporting loan officers in their day-to-day tasks, to increasing daily efficiencies for the accounting department.

Cloud computing allows the mortgage ecosystem to no longer be as segmented but rather, exist in a more holistic environment of insights and solutions that deliver a seamless digital experience. Mortgage professionals are already leveraging cloud technology to make smarter, more informed decisions.

The Mortgage Bankers Association's Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) Nominating Committee seeks members' recommendations for individuals to serve on the Board beginning this October in the Investor, Lender, Mortgage Banker and Servicer categories.

Does your company have a process of activities that, when followed, significantly increases a motivated LOs likelihood of success? Well, if your company is like most in this industry, you know the answer to that question.