Home Price Gains at Historic Highs

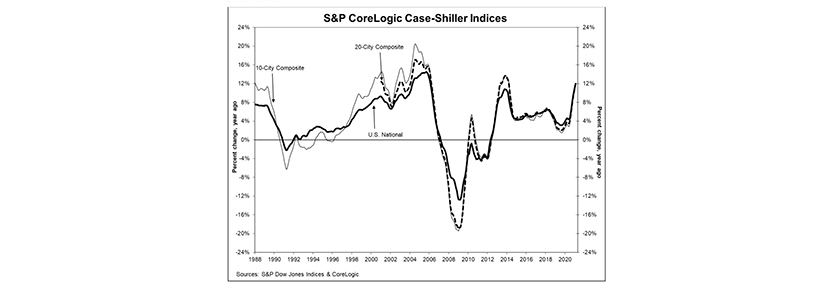

(Chart courtesy S&P CoreLogic Case-Shiller.)

Home price appreciation continued to accelerate at a double-digit percentage pace, with gains at historical levels, according to the S&P CoreLogic Case-Shiller Indices.

The U.S. National Home Price NSA Index reported a 12% annual gain in February, up from 11.2% in January. The 10-City Composite annual increase came in at 11.7%, up from 10.9% in the previous month. The 20-City Composite posted an 11.9% year-over-year gain, up from 11.1% in the previous month.

Phoenix led with a 17.4% year-over-year price increase, followed by San Diego at 17% and Seattle at 15.4%. Nineteen of the 20 cities reported higher price increases in the year ending February from the year ending January.

Month over month, before seasonal adjustment, the U.S. National Index posted a 1.1% increase, while the 10-City and 20-City Composites both posted increases of 1.1% and 1.2%, respectively, in February. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.1%, while the 10-City and 20-City Composites both posted increases of 1.1% and 1.2%, respectively. All 20 cities reported increases before and after seasonal adjustments.

“The National Composite’s 12.0% gain is the highest recorded since February 2006, exactly 15 years ago, and lies comfortably in the top decile of historical performance,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “Housing’s strength is reflected across all 20 cities; February’s price gains in every city are above that city’s median level, and rank in the top quartile of all reports in 18 cities.”

Lazzara said these data remain consistent with the hypothesis that COVID has encouraged potential buyers to move from urban apartments to suburban homes. “This demand may represent buyers who accelerated purchases that would have happened anyway over the next several years.” he said. “Alternatively, there may have been a secular change in preferences, leading to a permanent shift in the demand curve for housing.”

The report said as of February, average home prices for metros within the 10-City and 20-City Composites are exceeding their winter 2007 levels.

“With national and city-composite indices, as well as all three price tiers surging at double-digit rates for the third consecutive month in February, the housing market is running full steam ahead—with many observers questioning where the train is heading and what the next stop will look like,” said CoreLogic Deputy Chief Economist Selma Hepp. “Nevertheless, while the sustainability question is reasonable, housing market strength is reflecting many of the positive and continually improving signs of the economic recovery, including employment gains, consumer savings and more purchase power among home buyers, all while mortgage rates remain historically low. More for-sale inventories and a narrowing pool of potential buyers will likely slow the speeding train, providing a clearer vision of what’s ahead.”