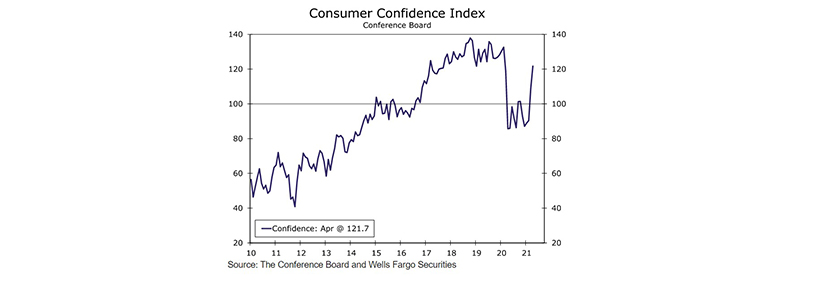

Consumer Confidence at 14-Month High

(Chart courtesy Well Fargo Securities, Charlotte, N.C.)

The Conference Board, New York, said its Consumer Confidence Index rose sharply again in April, following a substantial gain in March, to its highest level since February 2020.

The Index now stands at 121.7, up from 109.0 in March. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—soared from 110.1 to 139.6. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—rose moderately, from 108.3 last month to 109.8 in April.

“Consumer confidence has rebounded sharply over the last two months and is now at its highest level since February 2020,” said Lynn Franco, Senior Director of Economic Indicators with The Conference Board. “Consumers’ assessment of current conditions improved significantly in April, suggesting the economic recovery strengthened further in early Q2. Consumers’ optimism about the short-term outlook held steady this month. Consumers were more upbeat about their income prospects, perhaps due to the improving job market and the recent round of stimulus checks. Short-term inflation expectations held steady in April, but remain elevated. Vacation intentions posted a healthy increase, likely boosted by the accelerating vaccine rollout and further loosening of pandemic restrictions.”

“The 12.7-point surge in consumer confidence to a pandemic-era high attests to what you can see in any newly reopened restaurant or uncancelled sporting event: things are trending back to normal,” said Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “As more people get the vaccine and life gradually returns to something reminiscent of normal, confidence is swiftly returning to where it was before the pandemic.”

Quinlan said March economic indicators largely exceeded expectations. “The key question is the extent to which the robust consumer recovery will continue as stimulus checks no longer pad disposable income for households,” he said. “On that score, this better-than-expected gain is encouraging.”

The report said consumers’ appraisal of current conditions improved significantly in April. The percentage of consumers claiming business conditions are “good” increased from 18.3 percent to 23.3 percent, while the proportion claiming business conditions are “bad” fell from 30.1 percent to 24.8 percent. Consumers’ assessment of the labor market also improved. The percentage of consumers saying jobs are “plentiful” increased from 26.5 percent to 37.9 percent, while those claiming jobs are “hard to get” declined from 18.5 percent to 13.2 percent.

Consumers’ optimism about the short-term outlook improved moderately. The percentage of consumers expecting business conditions to improve over the next six months rose marginally, from 40.3 percent to 40.5 percent, while the proportion expecting business conditions to worsen stood relatively unchanged at 11.9 percent. Consumers’ outlook regarding the job market was slightly less upbeat. The proportion expecting more jobs in the months ahead fell from 35.9 percent to 34.5 percent, while those anticipating fewer jobs rose from 14.4 percent to 15.5 percent. Regarding short-term income prospects, 17.9 percent of consumers expect their incomes to increase in the next six months, up from 15.4 percent in March. Those expecting their incomes to decrease fell to 10.9 percent, down from 12.6 percent.