MBA Chart of the Week Apr. 5, 2021: Value of CRE Construction

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

And MBA’s quarterly Commercial/Multifamily Mortgage Origination Index tracked rebounds in borrowing and lending for industrial and multifamily properties in fourth quarter 2020, while originations for retail and office properties continued to languish.

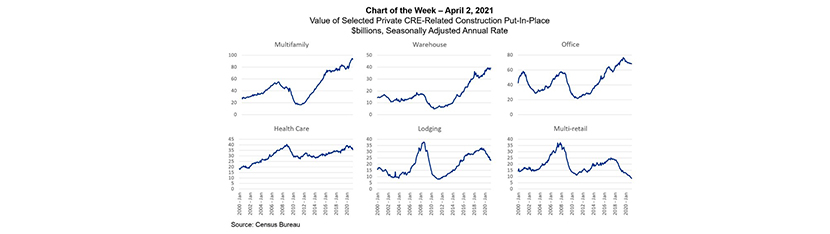

The U.S. Census Bureau’s monthly data on the value of construction put-in-place provides additional insights, particularly with regard to developers’ confidence that certain property types will “bounce-back” post-pandemic.

According to the data, multifamily and warehouse construction stand out – in alignment with the resilience of, and continued investor interest in, those sectors. The value of multifamily construction in February 2021 was 15 percent higher than a year earlier and down just slightly from an all-time high annual pace in January of more than $94 billion, lining up with the continued strong clip of multifamily permits (527,000 in February) and starts (372,000), and the roughly 650,000 multifamily units currently under construction. Similarly, warehouse construction has been running at a record annual rate of roughly $38 billion over the last year.

These surges in construction contrast to the marked fall-offs in lodging and retail construction, matching the pandemic-driven struggles for those sectors. The value of lodging construction put-in-place in February was down 24% from pre-pandemic levels. Construction of multi-retail properties has fallen 66% from 2017 cycle highs – reaching an all-time low pace of less than $9 billion per year in February.

Commercial real estate is a market driven by supply and demand, and the delivery of new supply is already adjusting to the impacts of the pandemic.

‐ Reggie Booker (rbooker@mba.org); Jamie Woodwell (jwoodwell@mba.org).