BREAKING NEWS

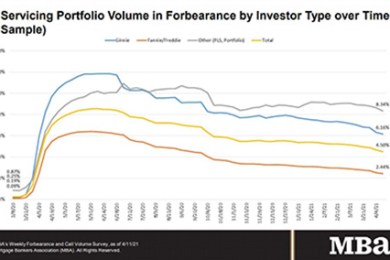

MBA: Share of Loans in Foreclosure Falls to 4.5%

The Mortgage Bankers Association recommended the Federal Housing Finance Agency align its actions on climate change and natural disaster risks with a set of core principles to reduce risk.

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 4.5% of servicers’ portfolio volume as of Apr. 11 from 4.66% the prior week. MBA estimates 2.3 million homeowners are in forbearance plans.

![]()

When the full effects of the coronavirus pandemic began hitting in March 2020, the Mortgage Bankers Association quickly realized that life as usual—and business as usual—could take a long time to return to “normal.”

Expanded unemployment benefits and federal stimulus payments are benefiting unemployed renters during COVID-19, reported Freddie Mac Multifamily, McLean, Va.

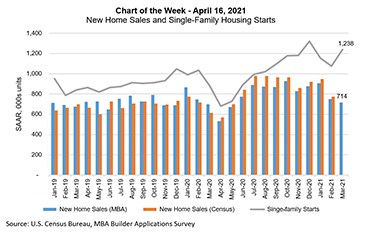

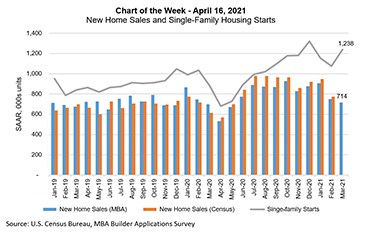

This week’s MBA Chart of the Week focuses on newly built homes, as measured by new home sales and single-family housing starts.

LoanScorecard’s Managing Director, Raj Parekh, looks at the new rules and what’s in store for non-QM.

Avison Young’s Florida Capital Markets Group closed the sale of the Residence Inn Coconut Grove, a three-building, 140-unit hotel at 2835 Tigertail Avenue in Miami’s Coconut Grove area.

The finance industry’s march towards transition away from LIBOR index continues as the third quarter approaches. For all the talk of upward revisions to economic growth projections, the market still awaits the first balance sheet commercial mortgage loan based on SOFR index.

Between stay-at-home orders, historical levels of refinance activity and the big increase in forbearance requests, mortgage originators and servicers spent the past year continually creating and re-creating ways to get things done. Here’s some of the things we saw.

The financial services industry as a whole continues to evolve at a rapid pace, driven by customer expectations, advancements in technology, and heightened competition from incumbents and new entrants. Lenders that seize this opportunity will not only survive, but ultimately thrive well into the future. In contrast, lenders content on simply surviving, taking more of a “wait-and-see” approach, may quickly become irrelevant.

The first article of this series addressed the use of behavioral activities as enabling goals. Their purpose: to help LOs who were struggling to reach the production goals to which you and they had agreed. This follow-up piece looks at management’s additional actions to consistently communicate about those observable activity goals.

Given the necessary delay that must precede the analysis of post-closing data, it is easy to forget the significance of these findings. However, mistakes made in the past often do not remain so, especially when those mistakes go unaddressed. Thus, lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.

On behalf of Mortgage Bankers Association Residential Board of Governors (RESBOG) Chair John Hedlund and Vice Chair Al Blank, MBA seeks members’ recommendations for individuals/companies to serve on RESBOG in future terms. This is an important process to develop MBA’s leaders among the residential policy membership.