Millennials Lean into Refis

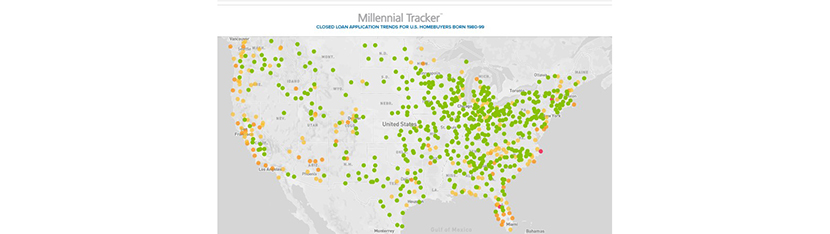

(Graphic courtesy ICE Mortgage Technology.)

Refinance activity increased sharply for Millennial borrowers in February, according to the ICE Mortgage Technology Millennial Tracker.

The report said refinances closed during February accounted for 54% of all loans to Millennials, up from 46% the month prior. This brought refinance share to a level not seen since April 2020 during the peak of the pandemic refinance surge, when it hit 55%.

Younger millennials also closed a record high share of refinances for the month. Joe Tyrrell, president of ICE Mortgage Technology, noted this age group, born between 1991 and 1999, typically closed more purchase loans than refinances as many are entering the housing market for the first time. However, in February, refinances accounted for 32% of loans closed by younger millennials – a significant jump. However, older millennials (born between 1980 and 1990) continued to be the driving force behind the refinance surge as 61% of all loans closed by this age group were refinances.

Average interest rates for all age groups changed little month over month at 2.88%. Younger millennials continued to secure marginally lower rates than their older counterparts, however, average interest rates for this age group increased to 2.85% while average interest rates for older millennials stayed the same at 2.89%. The average age of millennial homebuyers also came in at 32.9, near January’s record high of 33.

“As we’ve seen with February’s refinance share increase, loan activity can change drastically from month to month, making it critical for lenders to set themselves up for success by adopting digital solutions early,” Tyrrell said Joe Tyrrell, president of ICE Mortgage Technology. “As we emerge from the pandemic, many borrowers will still want to complete the mortgage process as virtually as possible.”