BREAKING NEWS

MBA Forecast: Record $1.67 Trillion in 2021 Purchase Originations

The Mortgage Bankers Association’s updated Economic Forecast projects 2021 purchase originations are on track to grow by 16.4% to a record $1.67 trillion.

Existing home sales fell in March, marking two consecutive months of declines, the National Association of Realtors reported yesterday, even as the market saw record-high home prices and gains.

The office has evolved over past decades, but the pandemic greatly increased how--and how fast--offices are changing, New York Times columnist and CBS Sunday Morning Contributor David Pogue said during the Mortgage Bankers Association’s Spring Conference & Expo 21.

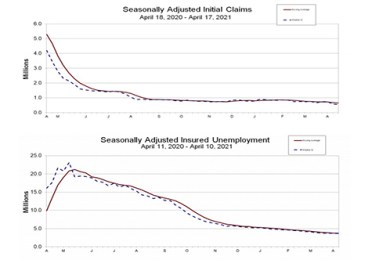

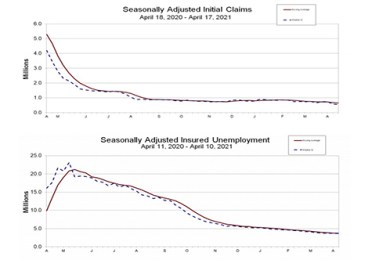

Initial claims fell to their lowest level since March 2020, the second-straight week of dramatic drops, the Labor Department reported yesterday.

Brookings Institution Senior Fellow Andre Perry says Black-owned homes are “systemically undervalued,” with obvious adverse consequences for wealth accumulation. And he has some ideas about what can be done.

LoanScorecard’s Managing Director, Raj Parekh, looks at the new rules and what’s in store for non-QM.

Capital One, Bethesda, Md., provided $61.3 million in Freddie Mac loans for the acquisition of two Colorado Springs, Colo., apartment communities.

You might say Ike Suri is feeling the love these days. The quality of his vision in the past four years has transformed how many of us work. Plus, it’s hard to ignore the head of a company that has reviewed more than $1 trillion (that’s trillion with a “t”) in closing value.

It’s easy to make Matt Hansen happy. “I just love writing code,” the Founder and CEO of SimpleNexus and MBA NewsLink 2021 Tech All-Star, said. “If I wasn’t writing code at work, which I did for 14 years, I was writing code at home. Even after a decade of it, I just couldn’t get enough of it.”

Amerifirst Home Mortgage, Kalamazoo, Mich., appointed Thinh Nguyen to serve as its chief information officer, responsible for all aspects of the company’s IT department, including its strategy, execution and infrastructure.

The finance industry’s march towards transition away from LIBOR index continues as the third quarter approaches. For all the talk of upward revisions to economic growth projections, the market still awaits the first balance sheet commercial mortgage loan based on SOFR index.

Between stay-at-home orders, historical levels of refinance activity and the big increase in forbearance requests, mortgage originators and servicers spent the past year continually creating and re-creating ways to get things done. Here’s some of the things we saw.

The Mortgage Bankers Association’s Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) Nominating Committee seeks members’ recommendations for individuals to serve on the Board beginning this October in the Investor, Lender, Mortgage Banker and Servicer categories.