BREAKING NEWS

Applications Dip in MBA Weekly Survey; Coverage of MBA Risk Management, QA & Fraud Prevention Forum; MBA, Trade Groups Ask Congress to Extend Flood Insurance Program Deadline

![]()

Mortgage Bankers Association Chair-Elect Susan Stewart kicked off the MBA Risk Management, Quality Assurance and Fraud Prevention Forum with an astute observation: the coronavirus pandemic has put such issues “front and center.”

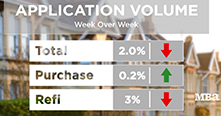

Mortgage applications fell for the fourth time in five weeks even as key interest rates held near record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending September 11.

With the National Flood Insurance Programs set to expire—yet again—the Mortgage Bankers Association and nearly two dozen industry trade groups asked Congress for another program extension as policymakers work on a longer-term solution.

When the coronavirus struck earlier this year, mortgage companies pivoted quickly toward remote working. Now they are working hard to keep their dispersed teams connected, analysts said Tuesday during the MBA Live Risk Management, QA and Fraud Prevention Forum 2020.

The coronavirus pandemic has increased market interest in eMortgages, reported Fitch Ratings, New York.

MBA is gearing up for its first-ever virtual Annual Convention & Expo. Taking place October 19-21 via MBA LIVE, attendees can connect whenever they want, from wherever they want.

Cute and customized face masks are wildly popular these days, launching a whole new industry. Closer to home, in our industry, popularity of vendors providing for Remote Online Notarization is surging. Thanks to the pandemic, RON vendors were rather unmasked, going from gaining marginal traction to epic growth – overnight. MISMO is leading the way, with a sharp machete clearing the path through the state level regulatory and compliance jungle.

In this industry, as part of the lender due diligence process, the financials and credit history of every mortgage banking customer are combed over and scrutinized. Mortgage banks search for any and every detail to properly assess the probability of loan repayment. However, when it comes to their own financials, not all lenders give as much consideration to the details as others.

Roostify, San Francisco, named Chris Boyle President of Home Lending, responsible for all external-facing functions, client engagement, strategy, marketing and business development.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

August mortgage applications for new home purchases increased by 33.3 percent from a year ago but fell by 4 percent from July, the Mortgage Bankers Association reported this morning.

CBRE brokered two southern California office building sales that totaling $26.75 million.