Mark Dangelo: Beyond Digital Transformation Part 2—Challenges of Digital Iterations

Mark P. Dangelo is Chief Innovation Consultant with BlackFin Group, Laguna Hills, Calif., responsible for leading and managing innovation-led business transformation and technology projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of four innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

The end of summer has arrived. However, for many across financial services and banking organizations along with the mortgage industry, the summer was extraordinarily busy. As #Covid-19 impacts consumer purchases, behaviors and expectations, FSBOs are struggling to get ahead of what is coming and how the vast troves of digital data buried in the clouds, locally and across partners can be leveraged to address “what is next?”

To further shed light on the impacts taking place across consumer actions, McKinsey highlights Covid-19 impacts where 75% of U.S. consumers have adopted new shopping behaviors (and brands), more than 40% have changed their spending habits and a more than 10% (permanent) shift of their total spend moved into omnichannel transactions than ever before. Before the pandemic, this last trend was identified in this MBA column a year ago demonstrating the continual move away from brick-and-mortar dependencies and consumer preferences to new channels of digital delivery.

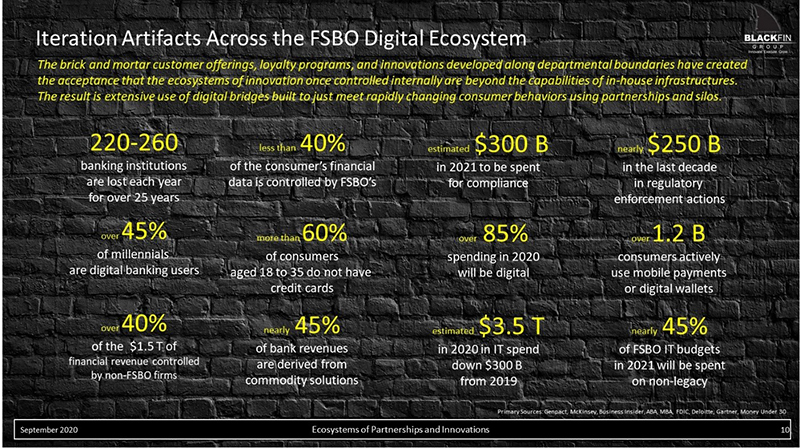

A quick look at a dozen data points showcase the varied and complex challenges facing FSBOs not only in 2020, but for the next five years.

Is Covid-19 the primary shift for consumer and business investment changes? Is the underlying rationale for the shifts attributed to a once-in-a-hundred-year event, or if we examined the data points across the FSBO supply chains (as referenced above) would we conclude different forces in play? Have we been building to a point where the next “iteration of digital” is now setting the stage for leveraging of data assets? If digital leverage is now in demand by products and business models, do we have the infrastructure, personnel (and skills), systems, partnerships and broad ecosystems of delivery needed to anticipate consumer changes and demands?

In part 2 of this series on the leveraging of all things digital, we note that Covid-19 was just the impetus to push forth digital trends already underway. Many of the questions, trends and needed investments have been delayed as the post #GreatRecession of 2009 ushered in record FSBO profits during the last decade. However, as 2020 has shown, this next decade indeed is squarely rooted in the leverage of digital that require a growing ecosystem of solutions across partnerships that are varied and granular. WARNING: If FSBOs do not leverage their investments in digital (often implemented to just compete), it will be the non-traditional firms that continue to gain financial marketshare at the expense of rigid brands.

Digital Leverage (#d.LEVERAGE) is Spurred by Financial Evolution

For many FSBO leadership teams, the discussion of digital is viewed as “been there, done that.” And that may be true for the 90% of organizations who have digitized manual processes and data entry. Sarcastically, some might say that this form of digitization and “digital transformation” is analogous to “paving the cow paths.”

However, the current and future challenges that have not been addressed in strategy or implementation is what should be done with those digital assets and initiatives beyond their silos of efficacy? How will these expensive and culturally changing solutions (increasingly cloud based) transform not just product and service processes, but also increase customer loyalty, mitigate risks, and reduce the expenses of financial solutions (now part of larger ecosystems of layered and compartmentalized technologies)?

The following slide depicts a few of the operational realities now facing the 5,100 FSBO’s (which by Q1 2021 will be under 5,000).

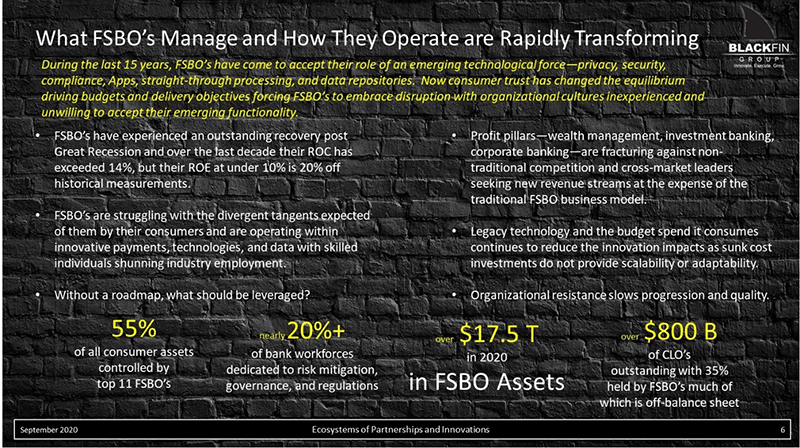

As we can deduce, the euphoria of the past decade is quickly being replaced with calculated realities. ROE (return on equity) is shrinking. Budgets are under pressure as global IT spend is projected to shrink by 10% in 2021 due to economic and healthcare concerns. Asset concentration within FSBOs continues to grow. Additionally, the Federal Reserve has fundamentally changed its governance of financial markets, creating uncertainty not just domestically, but internationally as foreign central bankers grapple with impacts to future dollar valuations and interest rate movements.

Moving forward, digital leverage is not about “going it alone.” To achieve relevancy and leverage traditional brick and mortar, FSBOs are increasingly partnering with cross-industry leaders to tap into data assets and customer behaviors. Moreover, to achieve a “one-stop shop” for financial offerings, which lead to the expansion of products, services and investments since 2015, FSBO leaders have linked their enterprises with technology firms offering financial solutions—with over 50 of these partners now boasting individual valuations greater than $1 billion. As the consumer ecosystem expands, so do the challenges FSBO digital transformations face as competitors seek multiplicative digital leverage beyond traditional approaches.

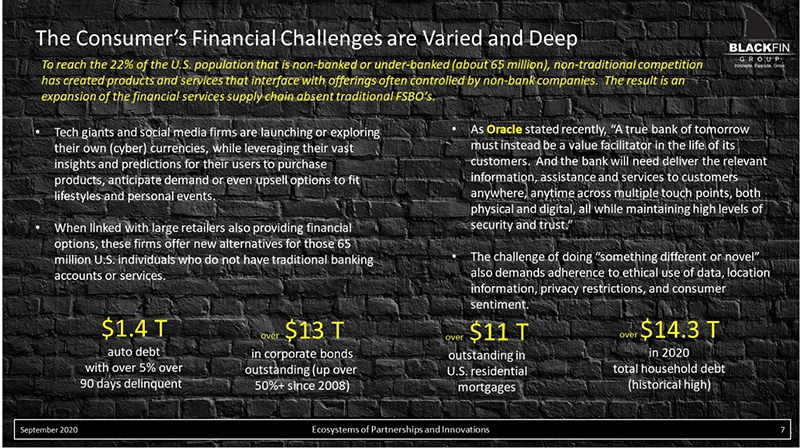

As FSBO challenges increase within consumer segments, we should note that not only are the numbers and concentration of obligations are rising (see previous graphic), but that customer behaviors and how they view and use financial solutions are now part of a greater ecosystem of delivery (e.g., linked to home AI systems, embedded within non-FSBO loyalty programs, or made disposable as in shared-transportation solutions). In general, consumer shifts (as pushed forward by Covid-19) will strain traditional FSBO digital delivery resulting in the rise of institutions embracing #BaaS (banking as a service) and Neobanks (virtual banks linked to the consumers digital life).

If addressed separately, these trends are incrementally challenging for even the largest of FSBO operations and their linked partners (e.g., outsourcers, vendors, software firms, retraining enterprises, and specialized technology providers). However, when addressed holistically, like the numbers presented in the three previous graphics, the impacts are disruptive against business models, service approaches, data ecosystems, and of course, personnel. And, now we arrive at the fulcrums for digital leverage within FSBOs—these events will comprehensively alter what it means to operate within financial services and banking.

Looking back at the growing list of cross-linked challenges, Julie Piepho, President of Consumer Banking with Adams Bank & Trust, reflects on the lessons learned in tackling digital initiatives:

“Having an executive sponsor for the company for digital transformation with a dedicated overall project manager and then dedicated project managers for each category of digital is key. It cannot all be done in one year or even two, and you must integrate it with the other company IT priorities unless you hire or outsource the IT capability for digital. That is what I wished I would have had on my staff was a dedicated IT team for digital transformation or outsource company that could have worked with the company’s software. The time, I believe, to implement would have been cut in half.”

Digital transformation is what FSBOs conducted before the rising challenges and demands for leveraged digital solutions. Moving into this new decade, we can clearly see when assessing innovational advancements in technology and customer service, that FSBOs will require dedicated “conductors” to assess progress, establish priorities, deal with continual shifting issues and address operational and organizational migrations that comprehensively disrupt the traditional practices—or pay a heavy price in dollars, time and quality.

In the Land of Digital, the Conductor is King

Looking back over the past decade, to secure customers and profits FSBOs have been forced into hastily arranged partnerships with retailers, payment processors, large IT firms and their outsourcing providers. These were often hastily arranged marriages to maintain relevancy in the face of rising financial offerings foreign to legacy FSBO systems and in-house skill sets.

Looking forward, who will ensure that these forced partnerships ecosystem integrations serve the FSBO goals and success criteria? Who has the master roadmap to filter additions and changes?

Chuck Iverson, EVP with Evergreen Home Loans, notes, “So far most of what I have seen is incremental change and would follow under more digitization categories. Obtaining source data and enhancements to the world of direct source data are the most fundamental disruptors, but these are not changing much across the industry in time frames or complexity. That is part of what will change as data can be obtained and processed quickly.”

What these challenges visually show is that there are large voids of strategy within FSBO models of operation. There are voids when mapping customers to FSBO products and services. There are lost opportunities and incomplete value propositions, which digital leverage could solve across the FSBO ecosystems. Yet, there are few resources with the skills or vision to assemble the fluid pieces into an actionable plan.

Moreover, the traditional option of partnering with organizations who have the building blocks necessary for assembling customer desired financial innovations, is now questionable due to the hidden complexities of how these layers operate, are verified, are expanded, and increasingly important, how they are retired (or swapped out). A tangential example of how digital migration can go horribly wrong (i.e., the challenges) can be considered from Citigroup’s $900 million mistake evidently attributed to an “upgrading system error.” From the early post-mortem, could this embarrassment have been avoided if digital leverage were utilized and bypassed manual checks (which failed)? And yes, it appears this was part of a larger ecosystem of solutions underpinned by outside partner involvement.

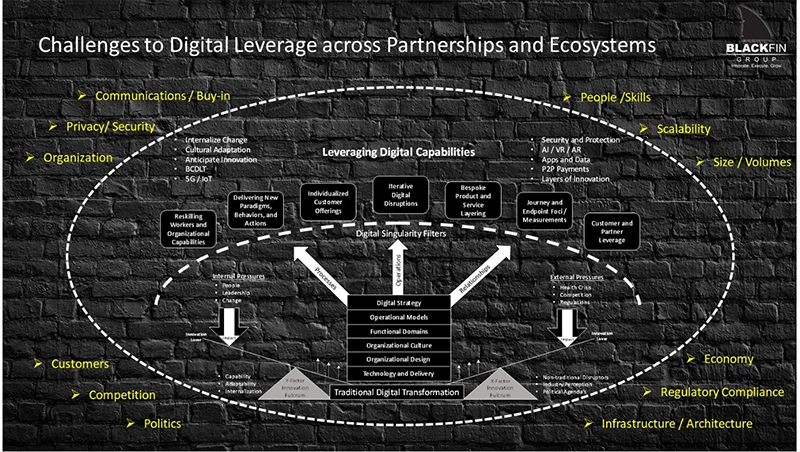

The center of the d.LEVERAGE diagram above was described in Part 1. If we examine the illustration now, we can see a dozen factors that impact the efficacy of FSBO digital projects and programs moving forward. As discussed, to mitigate the challenges of digital leverage, FSBOs must examine standard practices (all items above the “digital singularity filter”). These challenges shown are often attributed to Covid-19, but as we reach the end of the article, we can clearly see their complexity cannot be rationalized to a single external event. These challenges have been there long before Covid-19, but they are more pronounced with consumer shifts, political polarization in an election year, and declining profitability now settling in.

One example of a standard practice that is being challenged is that FSBOs once used labor arbitrage to deliver against rising costs of digital processes. Many FSBOs relied heavily on workforces outside domestic shorelines. Now with national interests rising, reshoring (i.e., repatriating workforces domestically) is changing the underlying business models and technology. Smaller FSBOs tied to singular vendors or platforms will struggle being flexible and nimble with innovative offerings due to the cost of integration and the ability to compartmentalize innovations as part of layers (within an ecosystem of delivery). The likely option will be for them to join industry cooperatives, or pass-on costs to their customers as “premium” offerings.

If the economic conditions stabilize or decline, FSBOs will embark on (traditional) comprehensive efficiency initiatives. These dogmatic approaches in turn will push more data outside the enterprise, while creating more tangential partnership relationships to address the innovation voids. The result for FSBOs will be fundamentally and permanently changed profit potentials, margins, and consumer bases. Moreover, as all corporations address the radical shift to hybrid or virtual workforces, the models used for lending, lines of credit, and risk management (to name just a few), will also require rapid and comprehensive vetting for these new ecosystems requirements, which are outside the traditional core competencies of many FSBO lines of business.

Consequently, most FSBO technologies, forecasting and digital initiatives that defined profitability before 2020 will collapse under rules, processes, and data that no longer foot to reality. #AI (artificial intelligence) and #RPA (robotic process automation) installed to provide visibility will also produce minimal viability as the unfolding events have not been rigorously modeled.

While cyber currencies, social marketing, bots, and blockchain started the financial revolution just a few short years ago, the movement away from traditional product and service delivery has accelerated especially with non-banks as they embrace digital leverage holistically rather than as siloed lines of business. Furthermore, the use of BaaS open source software, while spurring on enterprise adoption and solution adaptability, has failed to account for the vulnerabilities in established FSBO supply chains regarding oversight and #IV&V (for auditability against use cases).

In the end, in an age of disruptive digitization, financial services and banking organizations (FSBOs) must seek out and leverage the next generation of digital transformations (i.e., d.LEVERAGE)—or become another yearly statistic of brands that have lost their (innovation) relevancy.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)