Millennial Update: They’re Buying Houses and Going into Debt to Fix Them Up

Reports by Ellie Mae and Bankrate.com show Millennials are pulling out their wallets not only to purchase homes, but to fix them up as well.

Ellie Mae, Pleasanton, Calif., said despite tight housing inventory across the country, Millennial purchase activity continued to rise in July, according to the latest Ellie Mae Millennial Tracker. Share of all purchase loans closed to millennials reached 61% for the month, up five percentage points from June. This increase marks the highest purchase share for the generation since March.

Ellie Mae said millennial purchasing power grew in July as the average interest rate for all loans closed by this cohort fell to 3.25%, the lowest since Ellie Mae began tracking this data. The previous low occurred just one month prior, when the average rate dropped to 3.36%.

Younger millennials, those born from 1991-1999, were the sub-group responsible for the most closed purchase home loans for the month (81%), while 19% were for refinances. This was a stark contrast compared to loans closed by older millennials (30-40 years-old), many of whom already own homes. Fifty-three percent of their loans were for purchases and 46% were for refinances.

Younger millennials also took advantage of FHA loans in July. Ninety-seven percent of closed FHA loans for purchases were for younger millennials, the highest percentage since Ellie Mae started tracking this data in 2016. In comparison, 92% of closed FHA loans by older millennials were for purchases.

Ellie Mae said younger millennials also closed loans with a slightly lower FICO score average of 728 in July, compared to older millennials with an average FICO score of 747. Average FICO score for all closed loans across the generation was 739.

“We’re seeing a new wave of younger millennial home buyers flood the market as we enter peak homebuying season,” said Ellie Mae Chief Operating Officer Joe Tyrrell. “With interest rates at historic lows, now is the perfect time for younger millennials to purchase a home and start building equity.”

Meanwhile, a survey from Bankrate.com, New York, found 75% of millennial homeowners are funding home upgrades between the start of the pandemic and year’s end, and nearly half (46%) of them are going into debt as a result. That includes using/planning to use a credit card and paying it off over time (30%), store financing (15%), a personal loan (10%), and home equity borrowing/mortgage refinancing (6%).

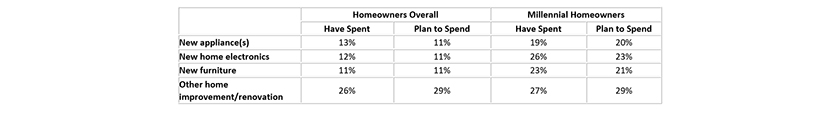

The survey said overall, 59% of all homeowners have either already completed (47%) at least $500 worth of home upgrades (including new furniture, new home electronics, new appliances, and other improvements/renovations) during the pandemic (i.e. since early March 2020) or plan to do so before the end of the year (48%).

As for funding these home upgrades, 32% of all homeowners took on debt or plan to take on debt to fund their upgrades, with millennial homeowners being the most likely cohort to do so (46% compared to 38% of Gen Xers, ages 40-55, and 21% of baby boomers, ages 56-74).

The survey said more than half of homeowners (58%) sourced/plan to source from a checking or savings account, while other methods include using a credit card and pay it off in full (37%), using a credit and paying it off over time (20%), store financing (8%), home equity borrowing/refinancing (6%), and personal loans (5%).

The survey can be found at https://www.bankrate.com/finance/credit-cards/covid-home-improvement-survey/.

“The home improvement industry is booming during the COVID-19 pandemic,” said Ted Rossman, credit card analyst with Bankrate.com. “Most people are spending a lot more time at home, and this is leading them to spend a lot of money and effort customizing their living spaces. I like seeing that so many people are using credit cards and avoiding interest, which is an excellent way to earn rewards. But there are also a lot of people putting these home upgrades on credit cards and financing over time, which can be one of the worst ways to borrow because the average interest rate is about 16%.”

Among those who have upgraded/plan to upgrade their homes, the most common projects are a bathroom (61%), kitchen (53%), home infrastructure such as roof, HVAC, etc. (52%), and major landscaping (52%). Additional projects include a bedroom (46%), other (44%), deck (43%), basement (23%), and pool (11%). Homeowners upgraded an average of 2.4 areas.

The survey of 1,271 U.S. adults took place online between August 12-14.