RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association's Research Institute for Housing America.

Fed Leaves Rates Alone; Ups Plans to Purchase Securities

The Federal Open Market Committee, as expected, left the federal funds rate untouched yesterday following its two-day policy meeting, and said it might stay that way until 2023.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Speaking virtually at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum, GSE analysts said despite challenges resulting from increased volumes, economic instability and a sharp spike in unemployment--as well an abrupt shift to remote working--lenders have shown adaptability and a commitment to loan quality.

Leading During Turbulent Times (MBA LIVE)

Risk managers face many challenges during this turbulent time, but the mortgage industry has largely been successful in weathering this pandemic, panelists said Wednesday at the MBA Live Risk Management, QA and Fraud Prevention Forum.

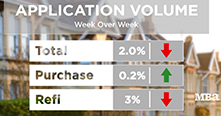

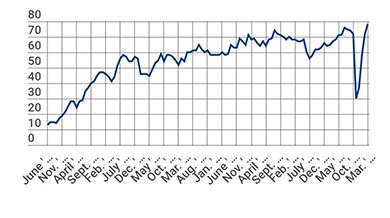

Mortgage Applications Dip in MBA Weekly Survey

Mortgage applications fell for the fourth time in five weeks even as key interest rates held near record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending September 11.