After Strong Summer, August Housing Starts Underwhelm

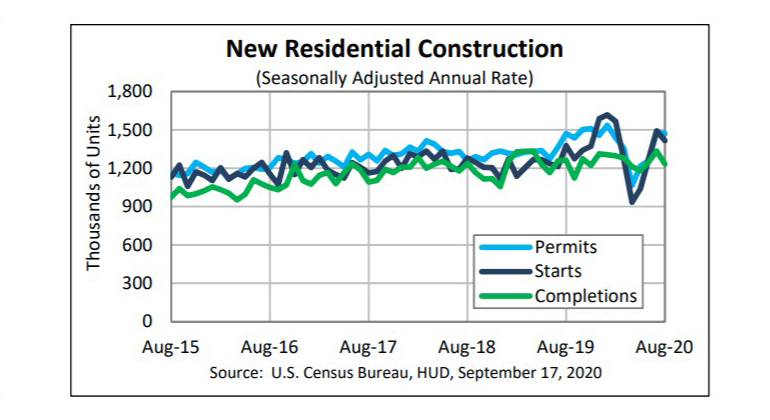

Housing starts—one of the bright spots in a red-hot summer housing market—faltered in August, HUD and the Census Bureau reported yesterday, although most of the decline took place in multifamily.

The report said privately owned housing starts in August fell to a seasonally adjusted annual rate of 1,416,000, 5.1 percent below the revised July estimate of 1,492,000. From a year ago, starts were 2.8 percent higher (1,377,000). Single-family housing starts in August rose to 1,021,000; 4.1 percent above the revised July figure of 981,000. The August rate for units in buildings with five units or more fell to 375,000, down by 25.4 percent from July’s revised 503,000 and down by nearly 17 percent from a year ago.

Regionally, results were mixed, as declines in the South and Northeast more than offset gains in the West and Midwest.

In the South, starts fell by 17.7 percent in August, seasonally annually adjusted, to 699,000 units from 849,000 units in July and fell by 2.6 percent from a year ago. in the Northeast, starts fell by 33.1 percent to 89,000 units in August from 133,000 in July and fell by 47 percent from a year ago.

In the West, however, starts jumped by 19.5 percent, seasonally annually adjusted, to 361,000 units in August from 302,000 units in July and improved by nearly 20 percent from a year ago. In the Midwest, starts jumped by 28.4 percent in August to 267,000 units from 208,000 units in July and improved by 40.5 percent from a year ago.

“While there is a constant lookout for evidence that the recovery is losing steam due to the ending of many major stimulus efforts, the underwhelming August housing starts data does not support that case,” said Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “We had expected to see some payback in August, following the prior month’s surge in multi-family starts, which jumped 37% in July to a 503,000 unit pace. One-month spikes in multi-family starts happen from time to time and are often reversed one or two months later.”

Vitner said apartment construction appears to winding down, with much of the slowdown coming in construction of high-rise urban projects in larger metropolitan areas. “Development is pivoting toward the suburbs, however, so activity is not headed dramatically lower,” he said. “On a three-month average basis, multi-family starts have averaged a 427,000-unit pace. We doubt that pace will hold up for the year, however. We expect multi-family starts to come in at around 385,000 units for all of 2020.”

Vitner also observed the recent spate of storms along the Gulf Coast appears to have temporarily slowed starts in the South, which typically account for more than half of the nation’s single-family housing starts each month. “The bulk of the South’s home building occurs in Texas and Florida, although builders in Georgia, the Carolinas and Tennessee are also incredibly busy and are selling homes faster than they build them,” he said.

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said despite the dip in August, strong fundamentals are giving home builders momentum, although supply-side challenges linger.

“The housing market continues to face a supply and demand imbalance, and the gap is at risk of widening if new supply cannot keep pace with growing demand,” Kushi said. “Builders see the lack of existing homes for sale as an opportunity to build more new homes, and homebuilder sentiment is now at an all-time high…However, supply-side headwinds remain. The rapid increase in the cost of lumber is, in turn, increasing the cost of building. And residential construction employment is still not back to pre-pandemic levels. Supply-side headwinds could slow the home-building momentum at a time when the housing market desperately needs new construction.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., noted in recent months, single-family new home sales have outpaced their usual relationship to starts, leading to a sizable backlog of homes to be built. “Additionally, inventories of existing homes for sale remain extremely tight relative to the pace of sales, likely driving many potential homebuyers to look at new homes for sale,” he said. “Together, these factors remain highly supportive of a strong pace of new housing construction in the coming months.”

The report said privately owned housing units authorized by building permits in August fell to a seasonally adjusted annual rate of 1,470,000, 0.9 percent below the revised July rate of 1,483,000 and 0.1 percent below the August 2019 rate of 1,471,000. Single-family authorizations in August rose to 1,036,000; 6 percent above the revised July figure of 977,000. Authorizations of units in buildings with five units or more fell to 381,000 in August, down by 17.4 percent from July’s revised 461,000 and down by nearly 29 percent from a year ago.

“Single-family permits rose to over a million annualized units, the highest level since mid-2007,” Duncan said. “We expect low mortgage rates, continued pent-up demand and increased interest in suburban areas in some metro areas will likely continue. Furthermore, we believe that the Federal Reserve’s recent policy announcement suggesting that short-term interest rates will remain lower for longer should help anchor longer-run rates like the mortgage rate, though this will also depend in-part on the Federal Reserve’s future management of inflation expectations.”

The report said privately owned housing completions in August fell to a seasonally adjusted annual rate of 1,233,000, 7.5 percent below the revised July estimate of 1,333,000 and 2.4 percent below the August 2019 rate of 1,263,000. Single-family housing completions in August fell to 912,000; 4.4 percent below the revised July rate of 954,000. The August rate for units in buildings with five units or more fell to 312,000, down by 15.4 percent from 369,000 in July and down by 1 percent from a year ago.