BREAKING NEWS

Record-Low Interest Rates Spur Refi Surge in MBA Weekly Survey

We apparently haven’t seen a bottom in mortgage interest rates—and it got a lot of borrowers off their couches, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending October 2.

Fitch Ratings, New York, said while remote working in the U.S. accelerated as a result of the coronavirus pandemic, and is reducing the importance of proximity to offices and causing migration from urban to suburban and exurban areas, it does not expect any material effect on the credit quality of its rated U.S. residential mortgage-backed securities pools.

Real estate investors have expanded their climate risk analysis to explore market-level impacts, said the Urban Land Institute, Washington, D.C.

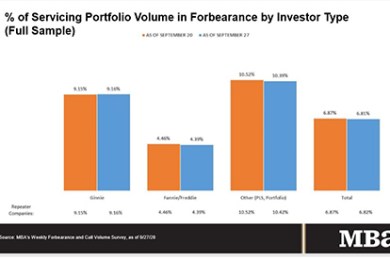

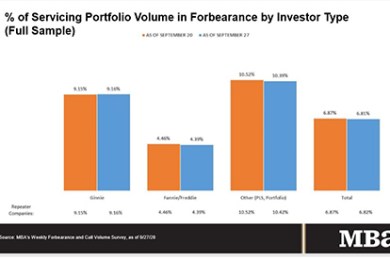

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

With record-low interest rates and an ongoing rush of refinance demand, mortgage lenders are racing to process as much business as they can. How can their settlement service providers help?

MBA is pleased to announce that Federal Housing Finance Agency Director Mark Calabria and Consumer Financial Protection Bureau Director Kathy Kraninger will take the virtual stage at MBA Annual20.

MBA NewsLink interviewed Valerie Achtemeier, Executive Vice President at CBRE Capital Markets in the Debt & Structured Finance Group. Based in Los Angeles, Achtemeier leads a team in placing debt and equity on commercial real estate throughout the U.S.

Temporary, alternative inspections methods help to demonstrate the reliability and benefits of bifurcation and may very well assist in the evolution of home appraisals.

Emerging technologies and start-up firms proliferated in commercial real estate over the last several years. With the conventional wisdom being that while the single-family real estate finance industry has embraced new technologies and innovation, CRE was a laggard and therein lies a massive opportunity.

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.

LERETA, Pomona, Calif., a provider of national real estate tax and flood services, acquired Accumatch. A Dallas-based property tax intelligence company. Terms were not disclosed.

Dwight Capital, New York, financed $143.5 million for multifamily properties in Washington, Arizona and Virginia.