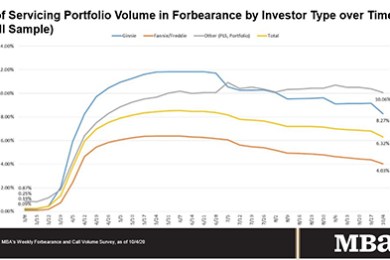

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

MBA Urges FHFA to Extend Current GSE Affordable Housing Goals

The Mortgage Bankers Association, in a letter this morning to the Federal Housing Finance Agency, said FHFA should extend current affordable housing goals for Fannie Mae and Freddie Mac, given current economic uncertainty.

Latinx Americans Driving U.S. Homeownership Gains, But Roadblocks Persist

“Remarkable growth” this past half-decade has boosted the share of Latinx households in the U.S. that own their home to its highest since the Great Recession, said Zillow, Seattle. However, despite these encouraging signs, roadblocks remain on the path to equitable housing.

Apartment Leasing Rebounds in Third Quarter

Apartment leasing proved strong in the third quarter, bouncing back from the limited demand seen earlier this year, reported RealPage, Richardson, Texas.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.