MBA Annual20: What 2020 Has Taught Us About Technology

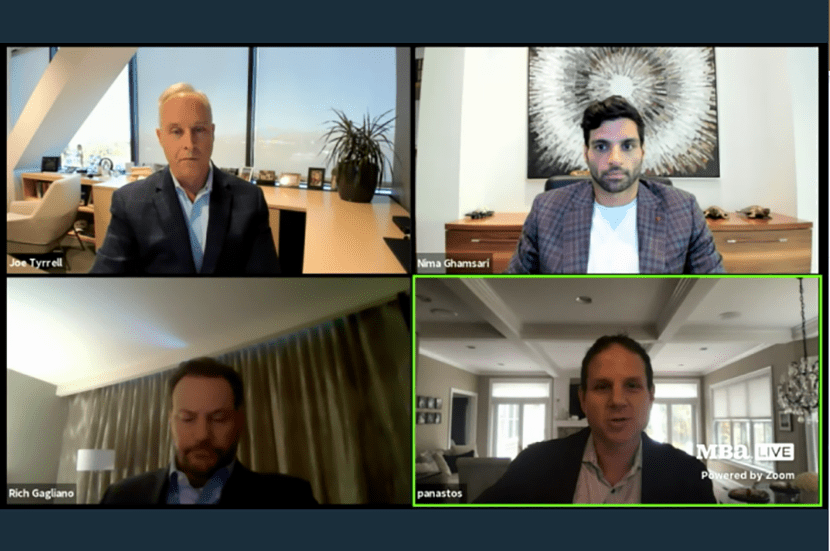

(Clockwise from top left: Joe Tyrrell, Nima Ghamsari, Paul Anastos and Rich Gagliano at the MBA Annual Convention & Expo on Oct. 20.)

Higher volume, lower interest rates and social distancing are changing customer expectations and mortgage industry technology.

“It’s been an interesting year due to COVID,” said Rich Gagliano, President of Origination Technologies with Black Knight, Jacksonville, Fla., during the recent MBA Annual Convention & Expo 2020. “First, we saw our industry adopt and adapt quickly–which is something the mortgage industry is not really known for. When COVID hit we saw working-from-home happen quickly really with little disruption. The second area I think is interesting is the e-closing component. What we saw there not only from our lenders but also from our title partners was the real acceleration of e-close, e-notary and Remote Online Notary. From our perspective, that has really taken off.”

Gagliano cautioned that the mortgage industry should not start to slow down now. “It’s an opportunity for our industry to really push through and start adopting more technology versus manual processes,” he said.

Paul Anastos, Chief Innovation Officer of Guaranteed Rate, Chicago, agreed e-closing is changing everything. “Certainly from a lender perspective, we needed a way to do closings in every single state; we needed a way that customers feel comfortable doing closings,” he said. “When you think about it practically and realistically, it’s really how customers want to close a loan.”

Anastos noted before e-closings, customers sometimes needed to take time off of work to go to a closing office. “You can e-close in two separate locations, which is often the case with family members during the course of a day,” he said. “It’s a convenience that really accelerated in this environment and will propel itself further because it’s very practical to how we live our lives.”

Nima Ghamsari, Founder and CEO of Blend, San Francisco, said new technology has opened up some opportunities to help consumers “in a better way for them and in a better way for the organization. Simple things like having people have more understanding about what their rates might be up front, so they can opt out before they fill out an application instead of filing out an application and then realizing they can get a better rate somewhere else for whatever reason.”

Ghamsari said technology improvements are “good for transparency, good for consumers and good for lowering lenders’ capacity constraints.”

“2020 was the year that challenged conventional wisdom,” said Joe Tyrrell, President of ICE Mortgage Technology, Pleasanton, Calif. “It challenged how we operate as an industry. For us, within 10 days [in March] we had 300,000 users that were all working remotely across our client base. So that was a wake-up call for a lot of lenders.”

Tyrrell said the pandemic really challenged the industry to rethink how we define collaboration. “It had lenders looking at customers’ experience over operational processes and thinking outside the box,” he said.