Absent Inventories, Home Prices Continue to Soar

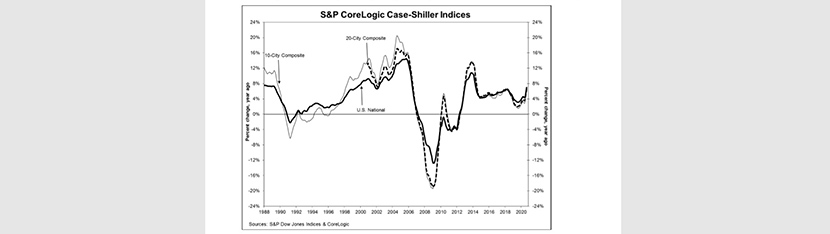

November saw no letup in the S&P CoreLogic Case-Shiller Home Price Indices, with home prices nationwide jumping by 7 percent annually. And the Federal Housing Finance Agency said it was even more, rising by nearly 8 percent.

The report said the National Home Price NSA Index reported a 7% annual gain in September, up from 5.8% in October. The 10-City Composite annual increase came in at 6.2%, up from 4.9% in the previous month. The 20-City Composite posted a 6.6% year-over-year gain, up from 5.3% in the previous month.

Among the 20 metros surveyed, Phoenix led with an 11.4% year-over-year price increase, followed by Seattle at 10.1% and San Diego at 9.5%. All 19 cities reported higher price increases in the year ending September from a year ago (data for the 20th city, Detroit, was not available for the report).

Month over month the National Index posted a 1.2% increase, while the 10-City and 20-City Composites posted increases of 1.3% and 1.2% respectively, before seasonal adjustment in September. After seasonal adjustment, the National Index posted a month-over-month increase of 1.4%, while the 10-City and 20-City Composites posted increases of 1.2% and 1.3% respectively. In September, all 19 cities (excluding Detroit) reported increases before seasonal adjustment, and after seasonal adjustment.

“Housing prices were notably – I am tempted to say ‘very’ – strong in September,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “A trend of accelerating increases in the National Composite Index began in August 2019 but was interrupted in May and June, as COVID-related restrictions produced modestly-decelerating price gains. Our three monthly readings since June of this year have all shown accelerating growth in home prices, and September’s results are quite strong.

Lazzara noted the last time the National Composite matched September’s 7% growth rate was more than six years ago, in May 2014. “This month’s increase may reflect a catch-up of COVID-depressed demand from earlier this year; it might also presage future strength, as COVID encourages potential buyers to move from urban apartments to suburban homes,” he said. “The next several months’ reports should help to shed light on this question.”

“Autumn housing indicators continue to show stronger than expected home sales and price growth, which are likely to remain through the rest of the 2020,” said Selma Hepp, Deputy Chief Economist with CoreLogic, Irvine, Calif. Nevertheless, a bumpy road is still ahead with new resurgence of COVID-19 cases and increased recommendations to shelter-in-place again. Still, record-low mortgage rates and desire for more space will keep buyers active in the market, though the strong seasonal effect that was delayed into fall months is likely to start fading.”

Hepp said while exploding COVID-19 infection rates suggest weighty economic uncertainty remains, housing markets continue to receive positive tailwinds, including the largest cohort of millennials, age 28 to 30 (about 15 million), are coming closer to the typical, first-time, home-buying age. “Additionally, mortgage rates are expected to remain at or below 3% into 2021,” she said. “These two factors will bolster the home buying market and continue propping up home price growth.

The report said as of September, average home prices for the MSAs within the 10-City and 20-City Composites are exceeding to their winter 2007 levels.

In a separate report yesterday, The Federal Housing Finance Agency said U.S. house prices rose 7.8 percent annually in the third quarter. Within the quarter, home prices rose by 3.1 percent, according to the FHFA House Price Index.

“House prices recorded their strongest quarterly gain in the history of the FHFA HPI purchase-only series in the third quarter,” said Lynn Fisher, Deputy Director of the Division of Research and Statistics with FHFA. “Monthly data indicate that prices continued to accelerate during the quarter, reaching 9.1 percent in September, as demand continues to outpace the supply of homes available for sale.”

FHFA said home prices have risen for 37 consecutive quarters, or since September 2011. House prices rose in all 50 states and the District of Columbia between the third quarters of 2019 and 2020. Top five areas in annual appreciation were 1) Idaho 14.4 percent; 2) Arizona 11.1 percent; 3) Washington 10.8 percent; 4) Utah 10.7 percent; and 5) Tennessee 10.0 percent. Idaho has been the leading state for the past eight quarters.

States showing the lowest annual appreciation were 1) North Dakota 4.0 percent; 2) Iowa 4.7 percent; 3) Louisiana 4.8 percent; 4) Alaska 4.9 percent; and 5) Hawaii 5.2 percent.

FHFA said house prices rose in all the top 100 largest metropolitan areas in the U.S. over the past four quarters. Annual price increases were greatest in Boise City, Idaho, where prices increased by 16.4 percent. Prices were weakest in Baton Rouge, La, where they increased by 2.1 percent.

Of the nine census divisions, the Mountain division experienced the strongest four-quarter appreciation, posting a 9.6 percent gain annually through the third quarter and a 3.8 percent increase in the third quarter. The Mountain division has been the leading region for 12 consecutive quarters. Annual house price appreciation was weakest in the West South Central division, where prices rose by 6.5 percent annually.