ANNOUNCEMENT

MBA Offices will be closed on Wednesday, Nov. 11 in observance of the Veterans Day Holiday. The MBA Weekly Applications Survey will go out on Wednesday as scheduled; MBA NewsLink will publish a special holiday edition.

In remarks yesterday during the Mortgage Bankers Association’s virtual Regulatory Compliance Conference, MBA President & CEO Robert Broeksmit, CMB, said the extraordinary events of 2020 have tested everyone’s mettle—including that of MBA.

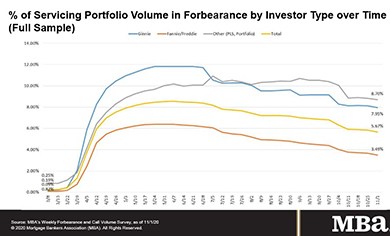

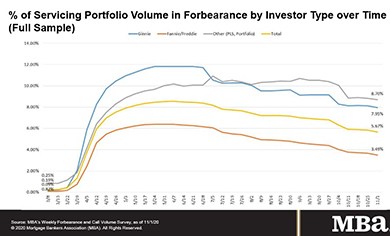

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Ahead of this morning’s quarterly National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said the 150-day delinquency rate reached its highest level since January 1999, noting that forbearance provisions have helped foreclosure rates maintain historic lows.

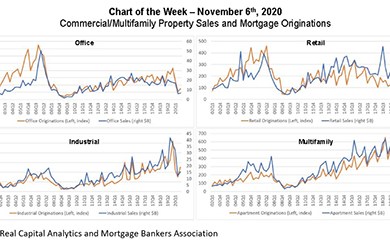

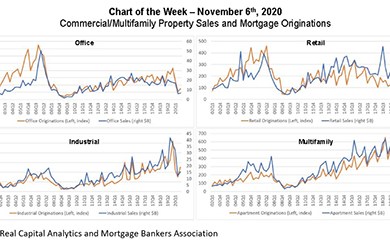

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

Selling and delivering as a business partner in today’s market, with Nationwide Title Clearing VP of Sales & Marketing, Danny Byrnes.

More than half of respondents to a survey conducted by BAI, Chicago, and the National Foundation for Credit Counseling said the coronavirus pandemic has affected their personal finances, making it difficult to pay some debts.

The MBA Mortgage Action Alliance Post-Election Update, taking place Thursday, Nov. 19 from 2:00-3:00 p.m. ET, provides MAA members (and prospective MAA members) with a briefing on election results to date and the anticipated impacts on the industry.

CBRE, Los Angeles, brokered two property sales in San Diego’s Kearny Mesa neighborhood for $111.3 million.

Trevor Gauthier is CEO of ACES Quality Management, formerly known as ACES Risk Management (ARMCO). He has more than 20 years of executive experience in leading growth initiatives for tech organizations and building teams both organically and through acquisition.

The digitization process has accelerated as mortgage professionals seek ways to efficiently meet the high demand for both purchase and refinance applications.

So, just how do architects, stakeholders, product owners, designers and users better interact with a mortgage software engineer? The first step is to understand what an engineer is and does.

MBA continues to closely monitor the results of our national elections and will provide a more thorough analysis as remaining details are finalized. In addition, MBA is closely tracking three California ballot initiatives that impact the real estate finance industry.