Employers Add 638,000 Jobs; Unemployment Remains Elevated

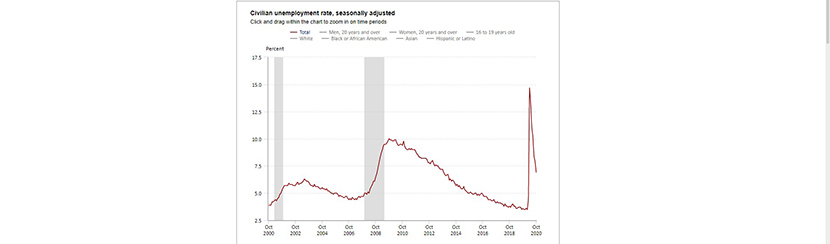

(Chart courtesy Bureau of Labor Statistics.)

The economy continued its high-low pattern in Friday’s employment report from the Bureau of Labor Statistics. While total nonfarm payroll employment rose by a strong 638,000 in October, and the unemployment rate fell to 6.9 percent, both numbers reflect the devastating economic effects of the coronavirus pandemic.

BLS noted improvements in the labor market reflect the continued resumption of economic activity that had been curtailed due to the coronavirus pandemic and efforts to contain it. But BSL acknowledged both the unemployment rate (6.9 percent) and the number of unemployed persons (11.1 million) remain nearly twice their February levels (3.5 percent and 5.8 million, respectively), despite having fallen for six consecutive months.

BLS revised up total nonfarm payroll employment for August by 4,000, from +1,489,000 to +1,493,000, and September by 11,000 from +661,000 to +672,000. With these revisions, employment in August and September combined was 15,000 higher than previously reported.

The report said among the unemployed, the number of persons on temporary layoff fell by 1.4 million to 3.2 million, down considerably from the high of 18.1 million in April but 2.4 million higher than in February. The number of permanent job losers, at 3.7 million in October, changed little over the month but is 2.4 million higher than in February.

BLS said the number of long-term unemployed (those jobless for 27 weeks or more) increased by 1.2 million to 3.6 million, accounting for 32.5 percent of the total unemployed. By contrast, the number of unemployed persons jobless 15 to 26 weeks decreased by 2.3 million to 2.6 million, and the number of persons jobless 5 to 14 weeks decreased by 457,000 to 2.3 million. The number of persons who were jobless less than 5 weeks was about unchanged at 2.5 million.

The labor force participation rate increased by 0.3 percentage point to 61.7 percent in October; 1.7 percentage points below the February level. The employment-population ratio increased by 0.8 percentage point to 57.4 percent in October but is 3.7 percentage points lower than in February.

“Job growth was much stronger than anticipated in October, with private sector payrolls up by more than 900,000,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Total employment remains 6.6% below the level in February, and indicates just how far we still have to go to re-attain full employment.”

Fratantoni noted some of the largest job gains in October were in those sectors hardest hit by the pandemic: leisure and hospitality and retail trade. “However, these sectors still have employment that is 4 million below February’s level,” he said. “Government employment declined due to the conclusion of the decennial U.S. Census count, and the continued job losses occurring in local education jobs.”

Fratantoni also noted the sharp decline in the unemployment rate this month occurred despite the fact that the labor force participation rate increased. “It remains about 1.5 percentage points below February’s level,” he said. “While the U-6 and other measures of underemployment remain quite elevated, they are declining almost as quickly as the headline rate. That said, there was an increase in the number of workers with part-time spots who wanted full-time work, an indication that people are making tough choices to go back to work because enhanced unemployment insurance benefits have ended.”

Mark Vitner, Senior Economist with Wells Fargo Securities, said as has been the case recently, “there are a lot of moving parts” within the employment data.

“Manufacturing, construction and logistics all remain bright spots, as businesses are frantically looking to replenish, restock and build inventories in the face of strong demand,” Vitner said. “High contact industries continue to bounce back solidly from their extraordinary lows, even as the bounce back in hiring appears to moderating elsewhere.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said the report had mixed messages.

“There is reason to be cautiously optimistic about the state of the economy – six months of expansion is good news, but the deceleration in the pace of improvement signals a slowdown,” Kushi said. “The path of the economic recovery is beholden to the path of the virus, and COVID cases have been on the rise, indicating new restrictions may be ahead.”

Kushi noted the housing market has been a bright spot amid the downturn, supporting the recovery of the broader economy. “Residential building jobs initially rebounded strongly from April’s low point, which was the lowest level since 2016, and are continuing the slow increase to pre-pandemic levels,” she said. “In the most recent report, jobs in residential building increased by 0.7 percent compared with one month ago, and hovers just 0.8 percent below its February level. In September, the supply of homes for sale fell to its lowest supply level ever. Lack of available labor is one of several headwinds faced by home builders today. Today’s report is not only a signal that the broader labor market continues to rebound, but welcome news for a housing market in desperate need of more supply.”

BLS reported average hourly earnings for all employees on private nonfarm payrolls increased by 4 cents in October to $29.50. Average hourly earnings of private-sector production and nonsupervisory employees rose by 5 cents to $24.82. BLS noted the large employment fluctuations over the past several months—especially in industries with lower-paid workers—”complicate the analysis of recent trends in average hourly earnings.”

The report said the average workweek for all employees on private nonfarm payrolls was unchanged at 34.8 hours in October. In manufacturing, the workweek increased by 0.3 hour to 40.5 hours, and overtime rose by 0.2 hour to 3.2 hours. The average workweek for production and nonsupervisory employees increased by 0.1 hour to 34.2 hours.