MBA Congratulates Joe Biden on Election as President

Mortgage Bankers Association President & CEO Robert D. Broeksmit, CMB, issued the following statement congratulating Joseph R. Biden Jr. on his election as 46th President of the United States:

MBA Advocacy Update–Nov. 9, 2020

MBA continues to closely monitor the results of our national elections and will provide a more thorough analysis as remaining details are finalized. In addition, MBA is closely tracking three California ballot initiatives that impact the real estate finance industry.

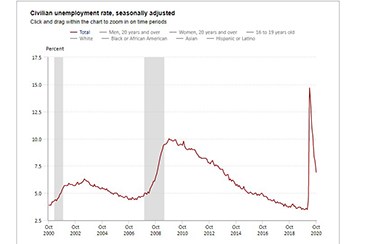

Employers Add 638,000 Jobs; Unemployment Remains Elevated

The economy continued its high-low pattern in Friday’s employment report from the Bureau of Labor Statistics. While total nonfarm payroll employment rose by a strong 638,000 in October, and the unemployment rate fell to 6.9 percent, both numbers reflect the devastating economic effects of the coronavirus pandemic.

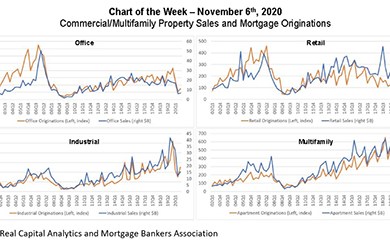

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

ULI Forecast Sees Potential Rebound in 2021-2022

The Urban Land Institute, Washington, D.C., said a consensus of real estate economists surveyed expect a short-lived recession and above-average GDP growth in 2021 and 2022.

MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019's record $601 billion, according to a new Mortgage Bankers Association forecast.