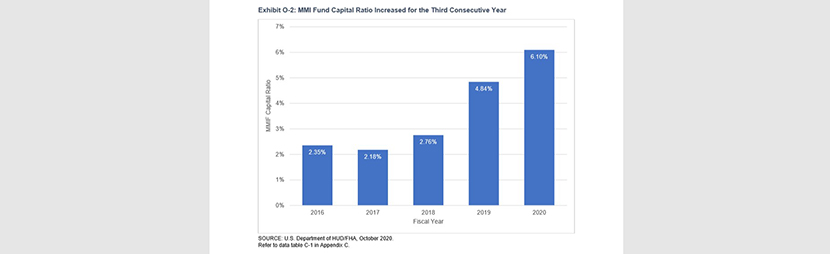

FHA 2020 Actuarial Report: MMI Fund Capital Ratio at 13-Year High

The Federal Housing Administration on Friday said its Mutual Mortgage Insurance Fund capital ratio ended fiscal year 2020 at 6.1 percent, well above its congressionally mandated 2.0 percent capital ratio to its highest level since 2007.

However, the report noted while dramatically improved compared to last year, the Home Equity Conversion Mortgage (HECM) reverse mortgage portfolio continued to run a negative capital ratio as of Sept. 30.

The FHA fiscal year 2020 annual report covers the financial status of the MMI Fund and its Single-Family insurance programs. The MMI Fund supports FHA’s Single Family mortgage insurance programs, including all forward mortgage purchase and refinance transactions, as well as mortgages insured since 2009 under the HECM reverse mortgage program.

The report said the 6.1 percent capital ratio represented an increase of 1.26 percentage points over FY 2019 and well above the congressionally mandated 2.0 percent capital ratio. Additionally, the report said the forward mortgage portfolio achieved a stand-alone capital ratio of 6.31 percent as of September 30, which helped subsidize the negative 0.78 capital ratio in the HECM program.

Dana Wade

“HECM is extremely susceptible to modeling input,” Assistant Secretary for Housing and Federal Housing Commissioner Dana Wade told reporters at a news conference Friday. “We expect fluctuations in the HECM program down the road…we also expect the strong housing market to continue, so we’re building a number of models.”

Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, issued the following statement in reaction to the report:

“Today’s report reconfirms the important role that FHA plays in providing access to the housing market for qualified first-time, minority and low- to moderate-income borrowers. It is gratifying to see the improved performance of both the forward and reverse mortgage books of business.

“HUD Secretary [Ben] Carson, Deputy Secretary [Brian] Montgomery, FHA Commissioner Wade, and the team at FHA are to be commended for continuing to improve their risk management strategies and enhance the stability of the MMIF. We look forward to working with HUD and FHA on further efforts to improve the program for borrowers and lenders alike while protecting taxpayers, especially with the ongoing challenges and uncertainty presented by the pandemic.

“As that picture becomes clearer, including how the 800,000 FHA borrowers currently in forbearance will exit, FHA should begin to re-examine premium levels, keeping in mind that maintaining prudent credit discipline enables FHA to play its countercyclical role supporting sustainable homeownership while expanding access for underserved communities.”

Other report highlights:

–As of September 30, FHA had active insurance on more than 8.3 million single family forward and reverse mortgages, with a total unpaid principal balance of more than 1.29 trillion. FHA market share decreased from 11.56 percent in FY 2019 to 9.61 percent in FY 2020.

–The share of first-time homebuyers using FHA insurance reached a new high of 83.1 percent of total FHA forward mortgage purchase endorsements in FY 2020. Similarly, the share of mortgages insured by FHA to minority borrowers reached almost 33 percent of all FHA forward mortgage insurance endorsements in FY 2020.

–The combined capital ratio for FY 2020 was 6.10 percent, an increase of 1.26 percentage points over FY 2019’s 4.84 percent capital ratio. The combined capital ratio is one indicator of the MMI Fund’s financial health and includes both the FHA-insured single family forward and reverse mortgage portfolios.

–FHA’s forward mortgage portfolio achieved solid performance with a stand-alone capital ratio of 6.31 percent as of September 30.

–While improved compared to last year, the HECM reverse mortgage portfolio had a negative 0.78 percent capital ratio as of September 30. In FY 2019, the HECM capital ratio was minus 9.22 percent.

–The forward mortgage portfolio continues to support the negative financial performance of the HECM portfolio. “The HECM portfolio’s future financial performance is highly sensitive to changes in House Price Appreciation and other economic factors,” the report said.

“As forecasted, this level of capital will help FHA withstand the immediate financial impacts to the Fund of the COVID-19 pandemic without requiring additional assistance from taxpayers,” the report said. “The report also provides the data and rationale to support a prudent capital management strategy moving forward so the Fund can continue to withstand any future or protracted economic stress events.”

“While we focused our efforts on helping FHA homeowners impacted by the global pandemic keep their homes, we balanced this with sound risk management to protect taxpayers,” Wade said. “We also continue to demonstrate that during these times, FHA is open for business.

Pinnacle Actuarial Resources Inc. served as the independent actuary for FY 2020.