MBA’s Bob Broeksmit commented on the Senate’s confirmation of Travis Hill as Chairman of the Federal Deposit Insurance Corporation; Frank Cassidy as Assistant Secretary, Department of Housing and Urban Development and Federal Housing Administration Commissioner; and Joe Gormley as President of Ginnie Mae.

Tag: Joe Gormley

MBA Releases Statements Encouraging Senate Confirmation of Frank Cassidy, Joe Gormley, Travis Hill

MBA’s President and CEO Bob Broeksmit, CMB, released a series of statements.

MBA Supports Nominations of Joe Gormley, Frank Cassidy to Lead Ginnie Mae and Federal Housing Administration

MBA President and CEO Bob Broeksmit, CMB, released two statements over the weekend supporting the nomination of Joe Gormley to serve as President of Ginnie Mae and Frank Cassidy to be Commissioner of the Federal Housing Administration.

MBA Supports Nomination of Joe Gormley to Be Ginnie Mae President

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the nomination of Joe Gormley to serve as President of Ginnie Mae.

People in the News Apr. 22, 2021

Amerifirst Home Mortgage, Kalamazoo, Mich., appointed Thinh Nguyen to serve as its chief information officer, responsible for all aspects of the company’s IT department, including its strategy, execution and infrastructure.

FHA Technology Initiatives Begin Bearing Fruit

A partnership between the HUD’ Office of the Chief Information Officer and HUD’s Federal Housing Commissioner, FHA Catalyst is a secure, flexible, cloud-based platform that provides a modern, automated system for lenders, servicers and other FHA program participants.

FHA Technology Initiatives Begin Bearing Fruit

A partnership between the HUD’ Office of the Chief Information Officer and HUD’s Federal Housing Commissioner, FHA Catalyst is a secure, flexible, cloud-based platform that provides a modern, automated system for lenders, servicers and other FHA program participants.

FHA Technology Initiatives Begin Bearing Fruit

A partnership between the HUD’ Office of the Chief Information Officer and HUD’s Federal Housing Commissioner, FHA Catalyst is a secure, flexible, cloud-based platform that provides a modern, automated system for lenders, servicers and other FHA program participants.

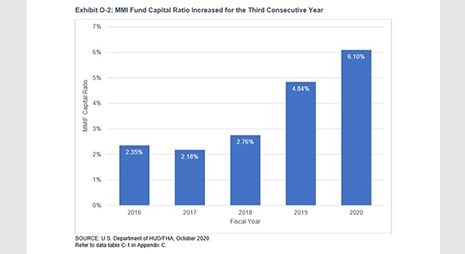

FHA 2020 Actuarial Report: MMI Fund Capital Ratio at 13-Year High

The Federal Housing Administration on Friday said its Mutual Mortgage Insurance Fund capital ratio ended fiscal year 2020 at 6.1 percent, well above its congressionally mandated 2.0 percent capital ratio to its highest level since 2007.

FHA Proposes Private Flood Insurance Option for Single-Family Mortgages

The Federal Housing Administration this week published a proposed rule to allow a private flood insurance option, instead of insurance through the National Flood Insurance Program, when flood insurance is required by FHA.