Mortgage Applications Drop in MBA Weekly Survey

Mortgage applications fell for the first time in three weeks—although purchase applications remained strong—the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending May 15.

The Market Composite Index decreased by 2.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased by 2 percent compared to the previous week.

The unadjusted Refinance Index decreased by 6 percent from the previous week and was 160 percent higher than the same week one year ago. The refinance share of mortgage activity decreased to 64.3 percent of total applications from 67.0 percent the previous week.

The seasonally adjusted Purchase Index increased by 6 percent from one week earlier. The unadjusted Purchase Index increased by 6 percent compared to the previous week but was 1.5 percent lower than the same week one year ago.

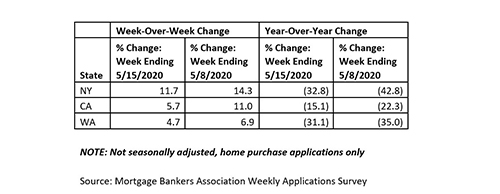

Looking at the impact at the state level, here are results showing the non-seasonally adjusted, week over week percent change in the number of purchase applications from Washington, California and New York:

The FHA share of total applications remained unchanged from 11.5 percent the week prior. The VA share of total applications decreased to 13.4 percent from 13.7 percent the week prior. The USDA share of total applications increased to 0.7 percent from 0.6 percent the week prior.

“Applications for home purchases continue to recover from April’s sizable drop and have now increased for five consecutive weeks,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Purchase activity – which was 35 percent below year-ago levels six weeks ago – increased across all loan types and was only 1.5 percent lower than last year. Government purchase applications, which include FHA, VA and USDA loans, are now 5 percent higher than a year ago, which is an encouraging turnaround after the weakness seen over the past two months. As states gradually reopen and both home buyer and seller activity increases, we will be closely watching to see if these positive trends continue, or if they reflect shorter-term, pent-up demand.”

Kan noted despite mortgage rates remaining close to record-lows, refinance activity slid to its lowest level in more than a month. “The average loan amount for refinances fell to its lowest level since January – potentially a sign that part of the drop was attributable to a retreat in cash-out refinance lending as credit conditions tighten,” he said. “We still expect a strong pace of refinancing for the remainder of the year because of low mortgage rates. With many homeowners still facing economic and employment uncertainty, these refinance opportunities will allow them to save money on their monthly payments, which can then be used to help other areas of their budgets.”

MBA reported the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.41 percent from 3.43 percent, with points increasing to 0.33 from 0.29 (including origination fee) for 80 percent loan-to-value ratio loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400) decreased to 3.66 percent from 3.69 percent, with points increasing to 0.37 from 0.33 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by FHA increased to 3.46 percent from 3.37 percent, with points increasing to 0.33 from 0.21 (including origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 2.88 percent from 2.92 percent, with points decreasing to 0.27 from 0.28 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 adjustable-rate mortgages decreased to 3.19 percent from 3.26 percent, with points decreasing to -0.05 from 0.04 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The ARM share of activity increased to 3.2 percent of total applications.

The survey covers more than 75 percent of all U.S. retail and consumer direct residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts.