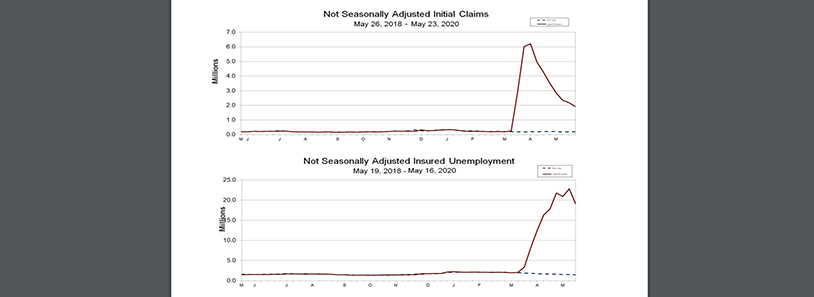

New Initial Claims at 2.1 Million; Total Claims Top 40 Million

American workers filed an additional 2.1 million initial claims last week, bringing the 10-week total for claims to nearly 41 million, the Labor Department reported yesterday.

Although initial claims fell for the eighth consecutive week, they remain at historically high levels; nearly one-fourth of the American workforce has lost jobs since the coronavirus pandemic exploded in late winter.

Labor reported for the week ending May 23, the advance figure for seasonally adjusted initial claims was 2.123 million, a decrease of 323,000 from the previous week’s revised level. The previous week’s level was revised up by 8,000 from 2.438 million to 2.446 million. The four-week moving average fell to 2.608 million, a decrease of 436,000 from the previous week.

The report said the advance seasonally adjusted insured unemployment rate fell to 14.5 percent for the week ending May 16, a decrease of 2.6 percentage points from the previous week’s revised rate. The previous week’s rate was revised down by 0.1 from 17.2 to 17.1 percent. The advance number for seasonally adjusted insured unemployment during the week ending May 16 fell to 21.05 million, a decrease of 3.86 million from the previous week’s revised level. The four-week moving average rose to 22.72 million, an increase of 760,250 from the previous week’s revised average.

“While the initial claims figure continues to trend downward from a peak of 6.9 million on March 28, claims still remain at historically elevated levels and continue to illustrate the unprecedented degree of labor market disruption being registered via reduced economic activity and falling consumer confidence due to the ongoing COVID-19 outbreak,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “While it is encouraging to see continued claims fall for the first time since the current crisis began, this number still represents close to 14 percent of the workforce. Continued claims represent the cumulative number of persons claiming unemployment insurance benefits at a point in time and is therefore a better, though still imperfect, measure of the total extent of joblessness present in the economy.”

Duncan also noted a few caveats. “On one hand, unemployment insurance eligibility rules have been relaxed recently, increasing the number of people who are able to apply,” he said. “This makes it difficult to estimate the uninsured unemployed share of the workforce. On the other hand, many states reported a significant backlog of unemployment insurance applications due to a lack of processing capacity, indicating that this week’s release may understate the true extent of insured layoffs.”