BREAKING NEWS

House Passes Two MBA-Supported Affordable Housing Bills (See Below)

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter, according to the Mortgage Bankers Association’s Commercial/Multifamily Delinquency Report.

The House yesterday afternoon passed two affordable housing bills that had strong support from the Mortgage Bankers Association.

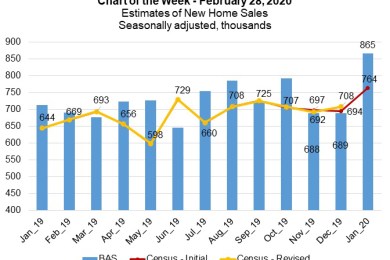

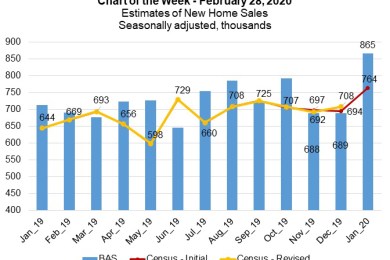

Want to get an early read of the U.S. Census Bureau’s monthly release of new home sales? Start following MBA’s estimates on new home sales in the monthly release of the Builder Application Survey.

CoreLogic, Irvine, Calif., said January home prices rose both year over year and month over month. Home prices increased nationally by 4% from a year ago; on a month-over-month basis, prices increased by 0.1%

Auction.com, Irvine, Calif., said its 2020 Default Servicing Insights report found while most respondents said they do not expect an economic recession in 2020, two-thirds expect their foreclosure and REO inflow to increase and 89 percent expect an increase in foreclosure and REO inflow from government-insured loans.

When loan origination volumes begin to drop, lenders must find ways to be more efficient to maintain profitability. Even with the growth of the past decade and the advances in technology tools, origination costs continue to rise, cutting into lenders’ bottom line.

Brian Zitin is Co-Founder and CEO of Reggora, Boston. Reggora is an appraisal technology company that gives mortgage lenders and real estate appraisers two-sided software that streamlines the appraisal process. The firm’s software automates manual processes from automatic order allocation to comprehensive quality control, freeing up time and decreasing costs for both parties.

On Monday, FHFA published an RFI initiating a review of its regulations governing FHLB membership. In addition, HUD announced at MBA’s Servicing Solutions Conference significant changes to FHA’s Claims Without Conveyance of Title (CWCOT) program that have been a long-standing MBA priority.

Planet Home Lending LLC, Meriden, Conn., hired Jim Bopp as vice president of national renovation lending. He will manage Planet’s retail and correspondent renovation loan programs, including FHA 203(k), VA Alterations and conventional loan offerings.