Mark P. Dangelo: Are Bankers Necessary?

(Mark P. Dangelo is president of MPD Organizations LLC, featuring books, industry reports and articles. He is a strategic management consultant, outsourcing advisor and analytics specialist with extensive process, technology and financial results and is a frequent contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.)

(Simplecast short link: https://into-our-future.simplecast.com/episodes/are-bankers-necessary)

In an age of innovation and rising artificial intelligence, are major functions facing commoditization, disintermediation or automation as synthetic intelligence increases? What will remain after data science advancements improve the efficacy of automation, as consumers increasingly move into a fully digital delivery model?

Let’s Frame Our Discussions

The start of this series will evoke some visceral responses—my apologies as we begin. This series is designed to question our foundations—in an age of disruptive innovation, are bankers necessary? We can see this taking place in the real estate markets where increasingly digitalization and automation are challenging the “necessity” of traditional commissions estimated to be more than $75 billion per year—or .30% of U.S. GDP.

We can witness this in the once tightly linked corporate bond market where in one investment bank shed 99% of their staff—due to innovation, data, process, and technology automation. Additionally, there is @Gartner which has been quoted that “Most banks will be made irrelevant by 2030” with “80% of financial firms” out of business or competitively swallowed—about 1.3 million out of the 2.05 million people now employed will be out of work. Others believe that across all of finance—of which banks comprise just a segment—over 6 million workers will be displaced by 2025. Where will these workers fit in now that algorithms have replaced their job description?

Yet, there is another school of thought. Others believe that the very technology putting people out of work and forcing them to seek alternative employment will boost job markets. Even as these workers struggle for skill relevancy and face rising personal costs for reskilling, the disparity of what #FSBO (financial services and banking organization) leadership should be doing when it comes to innovation, reskilling of workforces, and products and services offered to customers, span alternatives across diametric poles.

That is the idea behind this series—to explore the challenges bankers face. Not to say bankers don’t matter—but to understand what DOES matter—to the customer, to the economy, and to the bankers. Is it not better to ask the questions ourselves then to react to market changes?

As consumers move 100% digital, as neobanks which have no physical footprint gain marketshare in an age of financial commoditization, as branch closures accelerate due to uncompromising legacy investments and strategy, should banks which have the intellect and experience be leading the disruptive transformation? Or, are we going to wait and watch institutional numbers dwindle to “irrelevancy” (i.e., the decades long trend of losing 200 to 250 banks every year)?

All this begs a “few” questions regarding financial innovation. First, does innovation create banking strategy or does banking strategy drive innovation? Secondly, as global populations move to near 100% subscription to online banking products by 2030 (under 50% now), will governments step in to enact greater personal security for transactions and identities? Thirdly, will banks emerge, a reformulation if you will, as data science and analytic enterprises feeding retail, transportation and even educational institutions?

Indeed, there is much to contemplate, debate, cajole and scream about as we ask, “Are Bankers Necessary?”

Part 1

It has been a storied history for bankers—one spanning more than 4,000 years! Banking has evolved and shifted with the times from bartering to changing currencies to providing loans to taking investment positions for the fostering of innovation and profit improvements. Over the millennia, those spearheading these economically critical functions enabled trade and promoted national interests. However, the stature of banks and their bankers over the last few decades have undergone material scandals the most recent of which erupted back in 2008 and nearly caused a cascading, global economic collapse. Let’s be honest the flash and self-interest of the yearly #Davos pageantry as not help the industry cause much either.

In modern times, these missteps and outright misdeeds have resulted in complex and invasive regulations enacted to ensure that these bad actors become better behaved in the future. But, does that even work? Aren’t these regulatory compliance demands written for what is known or has occurred rather than to address events across what the World Economic Forum (@WEF) labels as the Fourth Industrial Revolution (#4IR)? Meaning, innovation allows for changes to take place that either intentionally or unintentionally removes the efficacy for these bitterly fought and penned regulations?

Therefore, as banking has evolved and become highly automated, an informed question is being surfaced—“Are banks or bankers necessary in a world driven by electronic exchanges, reporting and innovation?” As chatbots become intelligent and with globally systems routinely exchanging information, the role and accountability once deemed as “human mandatory” is now performed by algorithms and vast data oceans. A cornerstone argument for banker’s existence resided in trust and cognitive capabilities, but these have been shown to be a red herring against scandals, Davos celebrations, and huge losses (and fraud) by rogue, senior personnel.

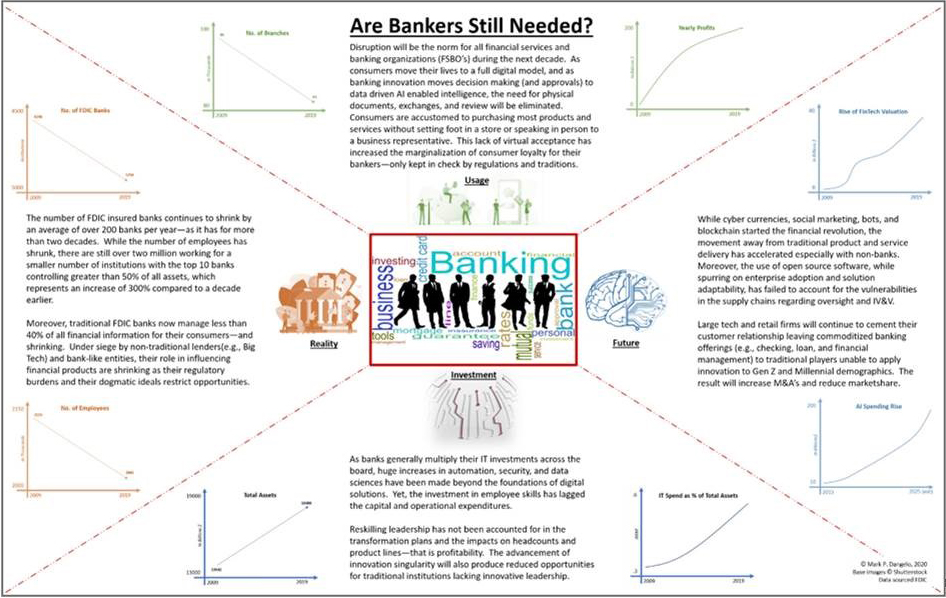

So, the question surfaces, are bankers and banks a relic of the prior centuries? How will they survive? How many people will they employ? What skills will be needed? Where will the transformative leaders appear? What is the current state when it comes to banking? What are the challenges moving forward? Perhaps a slide on this will frame some of the macro points encompassing an industry under substantial transformation.

The key messages buried with the above data is how and who interprets it. Will the consumer bond with financial innovations resulting in an unquestioned singularity? Without a doubt, banking as a set of functions and as a holistic industry, with its sometimes-opaque supply chains, is rapidly transforming. However, is banking a declining industry—Are Bankers Necessary?

Is it Just About Tech—Fintech, Consumer, IoT, Synthetic Intelligences, Data Sciences?

Banking in the early decades of the 21st century has been built foundationally upon information—oceans of it—from sources inside and outside of enterprise control. With #Fintech (i.e., Financial Technology) and other large data decision making capabilities, there has been an argument for either keeping bankers (because we know them), or to radically adapt their purpose in a marketplace and supply chains now rampant with change. So why not “eliminate” the banker?

Others emphatically retort, “To eliminate bankers, especially in times of market corrections and crises, create unworkable situations resulting in the eventual collapse of global economies!” So, which is correct, or do they both have validity when viewed across a spectrum? Perhaps banking is “outdated” because there is still a need, demand or comfort for branch and back-office thinking? What happens to branches in a world wrestling with pandemics? Let’s look at a pinhead’s worth of disruption taking place.

- As augmented reality takes shape, what will it do to branches? Will these existing investments be the footprint for bankers to engage customers of the future with “practical #AR”?

- Will the use of chatbots replace the teller function as synthetic financial intelligence moves into chip form supported by deep data responses? Will these bots extend the in-home personal assistants allowing bankers to practice inside a consumer’s home, car or mobile world?

- Transaction are becoming faster and instantaneous, so why do regulations need to exist for currency reporting, stock settlements, and even overdrafts? With data at a consumer’s fingertips, then what is the point for bankers in a peer-to-peer financial transaction model?

- Predictive behaviors of customer and opportunities driven by deep data and machine learning may be insightful and even profitable, but don’t they begin with a banker’s experience?

- With greater demand for climate solutions that span cradle to grave, will bankers provide the impetus to solve these historical wastes in an “reuse” set of disciplines estimated to add $1 trillion to global economies in just five years?

- As banker’s and their financial technologies drive new business models, is the very funding of innovation disruption firms laying the seeds for their own obsolescence from traditional, commodity delivered products and services (e.g., approvals, lending, credit ratings)? Will bankers (and the greater FSBO’s) be forced to adjust their own business models to offer only high value services? Has the reality that their control over financial data altering models now that it is approaching just 35% from heights exceeding 85% just two decades prior?

Some learned advocates defend the need for humans in banking operations and customer facing functions as a necessary “human emotion”—banking is predicated on a need for humans to interact with humans rather than just deliver a turnkey function. Perhaps this is just accurate for discrete demographics? However, with an estimate that by 2027 the entire world (about 8.5 billion individuals with 20% non-banked or underbanked) will be online and mobile capable, does banking have to take place using an intermediary who benefits from the transaction? The rise of P2P payment platforms and startups shows a consumer demand for something non-traditional.

So, I ask again, Are Bankers Necessary?

Will Cultural “Currency” Limit Our Discussions?

If I was reassessing my career or just starting out, would I choose a #FSBO as my first choice? I find it a bit perplexing, that headlines discussing careers, innovation, and even educational tracks tell the advice seeker to “focus on the positive”, while ignoring negative information to alter skills and competencies. I might guess for these author’s, that in their accounting classes the “T” column report only showed an asset side—not a liability side? Like our love for innovation and the singularity that we increasingly adopt, we believe that our choices will be benevolent sunshine and lollipops. Conversely, those who lump bankers to the same behavior as “ambulance chasing” lawyers should be viewed with the same clear-eyed judgement—that is, if something doesn’t go right sue everyone around and then make up facts.

Indeed divisiveness—positive and negative—are the currencies of the realm today. If you are extreme enough or you can gaslight others into believing, then that is acceptable. If we as an industry subscribe to these ideals, if we fail to remind those leaders that they are misguided, then we have no one to blame but ourselves.

So, like many of my articles written over these past 16 years for this publication, I would like to believe I inspire a few questions to be asked, a few principles to be challenged, and a use of innovation that is not singularly about following competitors or pundit strategy. There are more parts for this article topic forthcoming—but before we can look at future states and operating models, we need to challenge our own value in a business world increasingly dominated by throw-away innovations.

As we frame out this discussion for moving into the next pats, I have asked a highly emotional question regardless of which side you take. It is a thesis with very little middle ground. For example, if we look at the presidential debates and candidates political positions, we find much to react to when it comes to those individuals seeking to cast FSBO enterprises and their leaders as having horns and a tail.

Yet, if we assessed the reality from the shouted extreme viewpoints and research the facts regarding FSBO positions and contents, doesn’t it simplistically come down to “Do you trust the person or machine making the decision or handling the data?” In an era of #KYM (know your machine), the auditability of events, actions, and decisions are the cornerstones of any trust equation be it person or machine. We all know that early adopters “assume” the integrity and security for their innovation usage is a foregone conclusion for them—until it isn’t.

In an age of innovation and rising artificial intelligence (#AI), are major functions facing commoditization, disintermediation, or automation as synthetic intelligence increases? What will remain after data science advancements improve the efficacy of automation (e.g., #RPA), as consumers increasingly move into a fully digital delivery model?

I am confident that this article will invoke rage from some, maligning from others, confirmation for a few, but hopefully at a minimum, operational and strategy questioning from all. If, as an industry, we cannot question our value, then are we prepared for politicians and those seeking personal gain to put us up on a pedestal that they are prepared to cut from underneath us? You don’t have to be clairvoyant to recognize that these industry opposition leaders are asking their followers, “Are bankers necessary?”

Stay tuned…

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)