Fed Cuts Interest Rates to Zero; Announces $700 Billion in Stimulus

The Federal Reserve yesterday pre-empted its own regularly scheduled policy meeting this week, announcing an extraordinary full percentage point cut to the federal funds rate and sweeping purchases of government bonds and agency mortgage-backed securities.

MBA Advocacy Update

Given the recent coronavirus pandemic, MBA has been working diligently to create resources and materials to help our members and their customers. The first item below details these efforts. Additionally, there are several other unrelated key updates we wanted to highlight in this week’s communication.

MBA: Commercial/Multifamily Mortgage Debt Grows by Largest Annual Amount Since 2006

The Mortgage Bankers Association this morning reported commercial/multifamily mortgage debt outstanding at the end of 2019 rose by $248 billion (7.3 percent) from a year ago.

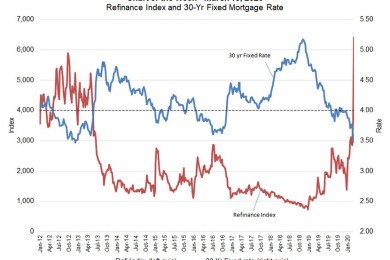

MBA Chart of the Week: Refinance Index and 30-Year Fixed Mortgage Rate

Treasury rates and mortgage rates have fallen to historic lows, driven down by the market turmoil and volatility caused by the uncertainty around the spread of the coronavirus.