MBA Survey: Share of Mortgage Loans in Forbearance Increases to 8.53%

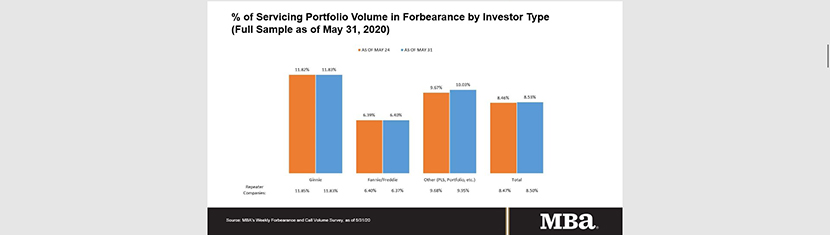

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 8.53% of mortgage servicers’ portfolio volume as of May 31, compared to 8.46% the prior week. MBA now estimates nearly 4.3 million homeowners are in forbearance plans.

The report said mortgages backed by Ginnie Mae again had the largest overall share of loans in forbearance by investor type (11.83%). Loans in forbearance for depository servicers dropped by 1 basis point to 9.18%, while loans in forbearance for independent mortgage bank servicers increased to 8.39%.

“The overall share of loans in forbearance increased by only 7 basis points compared to the prior week,” said MBA Chief Economist Mike Fratantoni. “With the job market beginning to gradually improve, more homeowners are exiting forbearance, and we are seeing declines in forbearance volume among some servicers.”

Fratantoni noted, however, this week’s findings revealed divergence among servicers., with the share of loans in forbearance decreasin for depository servicers but continuing to increase for IMBs. “While servicers reported only a 1-basis-point increase in the forbearance share for GSE and Ginnie Mae loans, the increase for private-label securities and portfolio loans rose to over 10 percent, which is higher than the rate on GSE loans.”

Key findings of MBA Forbearance and Call Volume Survey – May 25-May 31

• Total loans in forbearance grew by 7 basis points relative to the prior week, from 8.46% to 8.53%.

–By investor type, the share of Ginnie Mae loans in forbearance increased relative to the prior week, from 11.82% to 11.83%.

–The share of Fannie Mae and Freddie Mac loans in forbearance increased relative to the prior week: from 6.39% to 6.40%.

–The share of other loans (e.g., private-label securities and portfolio loans) in forbearance increased the most by investor type and relative to the prior week: from 9.67% to 10.03%.

• Forbearance requests as a percent of servicing portfolio volume (#) dropped across all investor types for the eighth consecutive week relative to the prior week: from 0.20% to 0.17%.

• The increase in weekly servicer call center volume was likely driven by end-of-month payment inquiries.

–As a percent of servicing portfolio volume (#), calls increased from 6.4% to 6.7%.

–Average speed to answer increased relative to the prior week from 1.3 minutes to 1.6 minutes.

–Abandonment rates increased from 4.0% to 5.2%.

–Average call length increased from 6.7 minutes to 7.3 minutes.

• Loans in forbearance as a share of servicing portfolio volume (#) as of May 31, 2020:

–Total: 8.53% (previous week: 8.46%) o IMBs: 8.39% (previous week: 8.21%) o Depositories: 9.18% (previous week: 9.19%)

This MBA Forbearance and Call Volume Survey represents 76% of the first-mortgage servicing market (38.2 million loans).