BREAKING NEWS

Applications Rise in MBA Weekly Survey

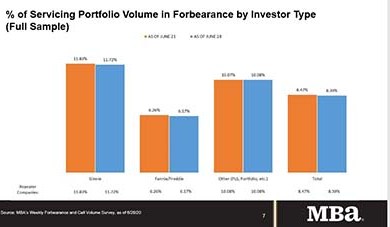

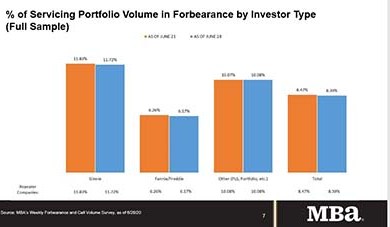

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

Mortgage applications increased for the first time in three weeks as key mortgage rates fell to yet another record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 3.

MISMO®, the mortgage industry standards organization, today announced eNotaryLog and Notarize are the first two companies to complete MISMO’s new Remote Online Notarization certification program. RON certification provides assurance that products fulfill the requirements of the MISMO Remote Online Notary Standards.

![]()

CoreLogic, Irvine, Calif., said home prices rose strongly in May, but warned that the effects of the coronavirus and subsequent economic downturn could send home price tumbling over the summer.

![]()

The Mortgage Bankers Association and nearly a dozen industry trade groups sent a letter this month to the Federal Communications Commission offering recommendations to improve an FCC draft order addressing robocalls and “spoofing.”

Daniel F. Mulvihill, Chairman Emeritus of Pacific Southwest Mortgage, San Diego, and former Treasurer of the Mortgage Bankers Association whose pioneering work with MBA helped make the annual CREF Convention & Expo one of the industry’s major commercial real estate conferences, died on July 1. He was 93.

This week in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Adherence to vendor management best practices needs to remain top of mind for lenders even when accelerating their digital mortgage tech selection and deployment process. Compliance with regulatory requirements and proper risk mitigation are not steps to be overlooked.

According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

We have successfully tackled using AI in newer areas, such as tiered contextual responses, voice recognition, biometrics and natural language processing. The fuzziness increases in emerging areas of AI use, including one where it’s especially common in mortgage banking – customer engagement using sentiment analysis and advanced contextual cues.

LenderClose, Des Moines, Iowa, appointed Martina Schubert as chief technology officer, responsible for aligning technological vision with the company’s needs to positively impact current and future operations.

NorthMarq, Minneapolis, negotiated $42.1 million in financing for New Jersey and Illinois multifamily properties.