BREAKING NEWS

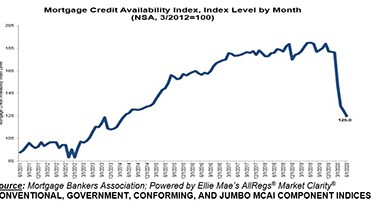

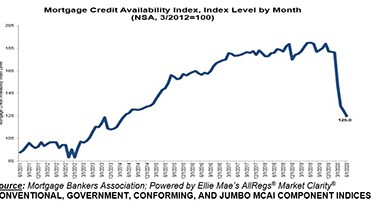

MBA Says June Mortgage Credit Availability Falls to 6-Year Low

Mortgage credit availability fell in June for the fourth consecutive month, remaining at a six-year low, the Mortgage Bankers Association reported this morning.

Here’s a summary of recent reports about the housing market and real estate finance, with reports from Zillow; Veros Real Estate Solutions; Fannie Mae; Redfin; Genworth Mortgage Insurance; and Computershare Loan Services.

![]()

June saw the largest month-over-month increase in the commercial mortgage-backed securities delinquency rate in more than 15 years, reported Fitch Ratings, New York.

Did you know electronic closings can occur in different ways? Take a closer look at two digital closing scenarios: hybrid and full eClosing with remote online notarization (RON).

MISMO®, the mortgage industry standards organization, today announced eNotaryLog and Notarize are the first two companies to complete MISMO’s new Remote Online Notarization certification program. RON certification provides assurance that products fulfill the requirements of the MISMO Remote Online Notary Standards.

As longtime industry participants, we at Housing Finance Strategies contend that the pandemic has created a revolutionary opportunity that we must seize and leverage so that the mortgage business can emerge with higher quality prospective products funded through a drastically reduced cost structure.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Adherence to vendor management best practices needs to remain top of mind for lenders even when accelerating their digital mortgage tech selection and deployment process. Compliance with regulatory requirements and proper risk mitigation are not steps to be overlooked.

Mortgage applications increased for the first time in three weeks as key mortgage rates fell to yet another record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 3.

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

This week in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.

Newmark Knight Frank, New York, brokered $55 million for a suburban office portfolio in Westlake Village, Calif.