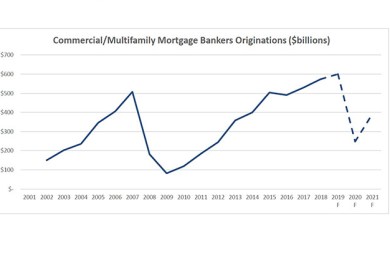

COVID-19 Pandemic to Cause Commercial/Multifamily Lending Pullback in 2020

Commercial and multifamily mortgage bankers are expected to close $248 billion in loans backed by income-producing properties this year, a 59 percent decline from 2019’s record volume of $601 billion, a new Mortgage Bankers Association forecast said.

Housing Finance Roundup: Purchase Market Strength; Millennial Buying Power; COVID-19 Effect on Homeownership Plans; Bidding Wars Intensify; Home Price Growth Persists

Here is the latest Housing Finance Roundup, with summaries of reports from Ellie Mae; First American Financial Corp.; Bankrate.com; Zillow; and Redfin.

ATTOM: Foreclosure Filings in 1st Half of 2020 Fall to Record Low

Things are kind of dicey in the housing finance market right now, with the economic impact of the coronavirus spiking unemployment and mortgage forbearance. But ATTOM Data Solutions, Irvine, Calif., says for now there is a silver lining.

Mortgage Applications Up Again as 30-Year Rates Hit Another Record Low in MBA Weekly Survey

Mortgage applications increased for the second straight week as the 30-year fixed rate fell to yet another record low, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending July 10.