MBA, Trade Groups Draft Model Remote Notarization Executive Order

The Mortgage Bankers Association, the American Land Title Association and the National Association of Realtors have developed a model executive order for states to enable remote notarizations during coronavirus pandemic.

The model executive order, designed for use by state governors, proposes legal protection of remote notarizations to preserve the public’s health and well-being in light of COVID-19. The order emphasizes use of electronic documents and virtual communications satisfy the legal requirements of notarizations.

“Our organizations believe that ideally it is better for the remaining states to enact RON laws consistent with the standards proposed by the non-partisan Uniform Law Commission’s Revised Uniform Law on Notarial Acts and/or the standards now in statute in half the states,” the groups said. “However, given the challenges of passing RON laws in half the states during the pandemic, we believe it is appropriate to ensure that any new or revised state RIN authorization language be crafted in a way that assures real estate sales are conducted in a manner that offers the most legal certainty. Therefore, we have developed this model executive order, which allows for the implementation of both RON and RIN in such a way that is consistent with minimum standards necessary for remote notarizations. We ask that governors and regulators use this proposal as they issue any new or revised guidance for electronic notarizations. This will not only ensure the soundness of home sales and refinancing, but also allow for a more consistent approach across states.”

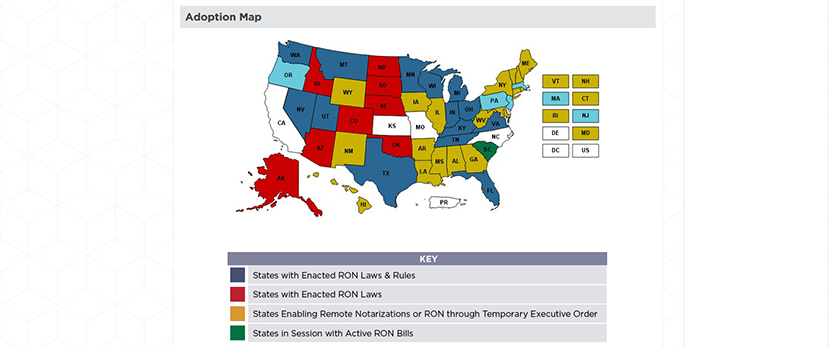

Kobie Pruitt, MBA Associate Director of State Government Affairs, said over the past two years, laws authorizing Remote Online Notarization have been enacted in 26 states. In recent months, many of these states have moved seamlessly to a “virtual” environment required by state and local public health ordinances. Meanwhile, many of the remaining states have hurriedly approved different forms of Remote Ink Notarization—also known as RIN—through executive order, proclamation or emergency rulemaking.

“These RIN-based approaches, however do not necessarily meet all the minimum standards for safe and secure real estate finance transactions. Therefore, to create greater legal certainty,” Pruitt said. “This model is meant to be a short-term fix for states without a permanent RON solution in statute and would like to complete notarizations remotely. Although the model allows for remote ink notarizations, it is still MBA’s position that RON is the best long-term solution and RIN should only be used to help the financial services industry during the health crisis.

Pruitt said the model executive order, as well as a model letter that can be shared with the executive order; a FAQ that can be shared with state leaders and other resources on the MBA RON Resource Center, are designed to cut through uncertainty stemming from the coronavirus pandemic. He noted as the pandemic spread, many financial service operations were not considered to be “essential businesses,” although in some states that did change.

“Our concern was that with the emergency nature of the pandemic, states were executing orders that weren’t really secure and didn’t meet the minimum standards for RON through either the non-partisan Uniform Law Commission or the ALTA/MBA RON bill,” Pruitt said. “What we were trying to do is give states a recourse, allowing for RIN and RON done in a way that was consistent with GSE guidelines and create legal certainty and increase both the insurability and salability for these loan products.”

MBA encourages its state partners and those engaged in advocacy at the state and local level to share the MBA/ALTA/NAR model with their respective governors or secretaries of state and encourage them to consider and adopt the model order instead of immediately renewing their current state emergency order.