Initial Claims Down Slightly Amid Continued Disruption

Initial claims filed with the Labor Department totaled 1.3 million last week, a decrease of just 10,000 from the previous week and a stark reminder of how the coronavirus pandemic has upended the U.S. economy.

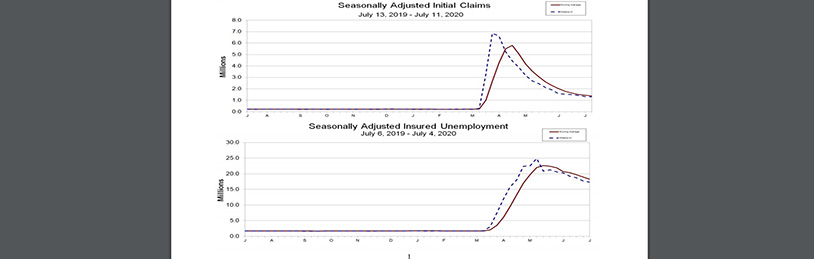

The report said for the week ending July 11, 1.3 million American filed initial unemployment insurance claims. The four-week moving average fell to 1.375 million, a decrease of 60,000 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate fell to 11.9 percent for the week ending July 4, a decrease of 0.3 percentage point from the previous week’s revised rate. The advance number for seasonally adjusted insured unemployment—also referred to as “continued claims”—during the week ending July 4 fell to 17.338 million, a decrease of 422,000 from the previous week’s revised level. The 4-week moving average fell to 18.272 million, a decrease of 737,750 from the previous week’s revised average.

Jay Bryson, Chief Economist with Wells Fargo Securities, Charlotte, N.C., said despite the drop—the 15th consecutive monthly decrease from the record 6.87 million filed in late March—initial claims remain “frustratingly elevated in an historical context.”

“[The] unemployment insurance report highlights that the labor market continues to face significant disruptions as a direct result of the ongoing COVID-19 outbreak,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “The pace of decline appears to have slowed in recent weeks, a troubling sign for the labor market recovery. Over the last 17 weeks, more than 51 million unemployment insurance claims have been filed.”

Duncan said continued claims, while down from its record high 25 million in early May, also remains elevated. “The gradual decline indicates the labor market is improving only incrementally and the total extent of joblessness remains unprecedented,” he said.