Mark P. Dangelo: The Challenges of Reskilling Workforces, Part 1

(Mark P. Dangelo is president of MPD Organizations LLC, featuring books, industry reports and articles. He is a strategic management consultant, outsourcing advisor and analytics specialist with extensive process, technology and financial results and is a frequent contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.)

We–that is, domestic industries in general–have a problem. It is a problem that has been growing for decades. Perhaps it is one we have always had, but more pronounced in one industry or another. It is accelerating quickly just as technology advances driven by synthetic intelligences, robotics, data availability and processing and innovation singularity becomes accepted business practices.

What is the problem, you wonder? Is it not enough housing? Is it too-easy credit? Is it growing caustic politics or inappropriate human behaviors? Is it too many regulations, or government malaise on the GSEs? Alas, for this discussion, it is something else.

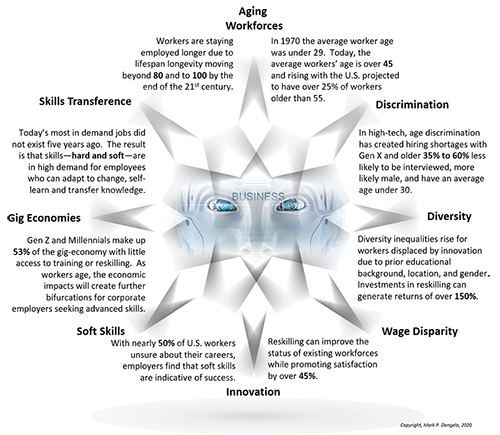

We have a perception problem. We have a skills problem. We have a problem with how to educate and train. We have a problem with those who teach change and disciplines. And, it is all circling around a fact that the average worker’s age in the United States has gone from under 29 in the 1970s to nearly 45 in 2020. I am positive that there will be those reading this who dispel the challenges of an aging workforce (1). Yet, the statistics of how poorly we are addressing age and the demand for reskilling can be witnessed in a singular EEOC statistic citing that more than six in 10 workers older than 45 have experienced documented age discrimination.

It’s a bit perplexing within developed, western cultures that only in the cases of celebrated business leaders (e.g., Branson, Buffet, Gates, Meyers, Mars) are domestic, new-age innovation workers accepting of industry experience (a euphemism for those >50). Would you believe that only 7% of those under 35 with Next-Gen skills view older workers as individuals who should be respected or emulated—and that includes those who hired them.

The Facts About an Evolving Workforce

Yes, “boomers” are retiring from their traditional “career” paths, but they are also still working well past the traditional retirement age of 65—out of desire, out of necessity and out of a fact that we (i.e., societal segments) are living longer. It is projected by several global symposiums (e.g., WEF) that if we don’t retrain and utilize our aging populations, trillions of dollars of economic value will be lost, and large demographic segments will be further disadvantaged, dragging governments into greater social support and requiring them to printing money they don’t have. These researched implications are noting that wealth gaps will grow, and racial and cultural diversity will suffer if the global markets continue to fracture and skilled personnel are locked into their origin countries.

The growing base of facts and trends then raise many questions for corporate leaders, #FinTech companies, #FSBOs (financial services and banking organizations), #lenders, #agents and anyone else that seeks to conduct business with aging workforces and their families. As workers desire and are expected to be in the enterprise delivery ranks longer, what will our operations do with existing personnel? How will enterprise leaders ensure that these aging workforces are not only incorporating new solutions and skills into existing processes, but also operating at outstanding efficiencies and exceeding customer expectations? How will existing workforces lead the initiatives for continuous disruptive innovation all the while achieving high levels of worker satisfaction? Many challenges surface on these complex questions with little historical forecasting able to illuminate the paths forward.

The following graphic from an upcoming report dealing with professional redevelopment and reskilling (i.e., The Innovation Dilemma), shows the complexity of the situation beyond aging workforces and the demand for innovative skill sets regardless of industry, affiliation, political beliefs or even wealth.

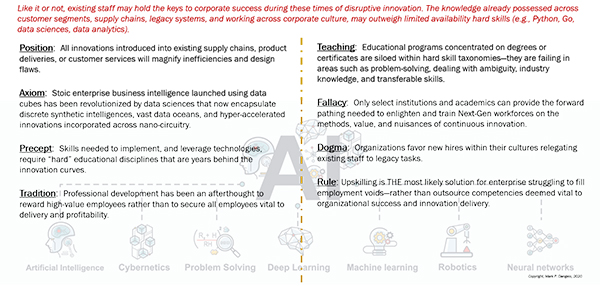

From all measurements, the accelerating announcements regarding advanced solutions (e.g., AI, machine learning, data sciences, KYM—know your machine) have outdistanced in-house training and education solutions. The skill complexity and employee applicability for inclusion into highly specialized customer models has never been more in question, as solutions hyper accelerate creating voids of capability which are needed to identify and manage growing synthetic intelligent solutions fueled by data, more data, and yes, much more data.

So, what should an enterprise do? Fire everyone and start over? Outsource everything except the vision? Invest in fulltime equivalents using traditional retooling and reskilling methods? Or should we do something else?

Harsh Realities for Existing Staff

If you subscribe to Bloomberg, a January article (Big Tech Is Coming for Banking: Experts Predict Fintech’s 2020), highlights 60 firms (2) with near (or more than) billion-dollar valuations who will transform segments of the financial services supply chain moving forward (3). Personally, it suggests that the disruptors and the investors who believe in them, will be pressing traditional firms and lenders for not only markets and consumers, but also to radically shift workflows, data sciences, inductions and deductions, and of course, how products and services are fulfilled.

Yet, what do these new firms offer besides advanced innovative technologies? Are they substitutions for staff? Will their efficiencies which are reducing the needs of traditional workers, become liabilities or transformation vessels ushering in new market leaders?

However, even if this new generation could deliver innovations most sought after by consumers and FSBOs, who will be the program managers supervising the discrete implementation projects? Who will lead the transformations beyond digitalization, and into the next set of layered solutions requiring orchestration? How will the integration of new personnel assets alter the cultural makeups of the enterprise, while promoting reskilling across teams and not just with a select few?

The harsh realities are not just with new hires—there are mountains of challenges already within the enterprise waiting for professional development to bring about new skills, lasting change and relevant performance appraisals. The following depiction from The Innovation Dilemma, highlights the challenges facing corporate reskilling (e.g., professional development) efforts.

Therefore, as we examine all the pressures on existing personnel to deal with continuous, disruptive innovation, we need to also accept the realities that the content and methods used to establish competencies as part of enterprise reskilling must also change.

So, Where Do We Go from Here?

First, we must move beyond the slogans that current and prior management leaders have attempted to use when it comes to changing behaviors, instilling measurements and altering product and service quality. We know from decades of experiences that the use of slogans and initiative names add little value to transforming enterprises let alone, transforming vast skill bases (e.g., #WEdwardsDeming). For managers seeking leadership high ground (without “doing the heavy lifting”), the use of “shifting paradigms” (borrowed from #DonTapscott’s books), “thinking outside the box” (derived from #SirArthurConanDoyle), and of course THE new one, “deep diving from high-level learning” (yet unclaimed), attempt to provide the rallying cries to energize staff—but without substance and new, disruptive learning techniques, they are simply hollow phrases.

Next, if projections hold true to emerging trends, machine or synthetic intelligences will become a staple of many operational actions now performed by real humans (making a hard distinction here, see #Samsung’s #Neon human replicas introduced at #CES2020). And, while the advice of HR personnel to staff often revolve around “take an AI class or two” to ensure relevancy, the out-of-context advice provides little return for employees and their corporation’s in the medium to long-term. To conduct a proper reskilling effort within an enterprise, leaders must not only map out what discrete skills are needed for current and future innovations, but also what is the baselines for each member of the staff.

Filtered against the information presented above, what are the opportunities? When compared against the future needs, how can transformative soft skills be inventoried to promote improved reskilling internationalizations, while accepting that future workers likely will be more polymath (4)?

As hiring and professional development departments increase their use of AI for employment screenings, the result of trying to normalize human capabilities into buckets of those most likely to add value and be “teachable” (outside of the current individual and class-action litigation), may result in the exact opposite.

While we will continue this discussion across additional articles, we can look back a decade and see a global firm, held up by managers and academics as THE standard to measure performance—GE. The idea of up and out, the cookie cutter approach to staffing, and the performance measures that drove out any employee variability, boosted their short-term performance. But where is GE today from their story book affair just a decade ago?

Indeed, there is more, much more to discuss.

- After all, our Western cultures prize youth. We glorify beauty and praise in new slang speak what is trendy as “lit” or “slay” (see Business Insider).

- And since the article was published, one of the firms was purchased for $3.4 billion stoking the belief that those remaining will be subject to a bidding war.

- Supply chain you ask, in financial services and banking organizations (FSBOs)? You might ponder, aren’t supply chains just a manufacturing and consumer product set of processes that ill-fits finance? No, the disciplines spanning supply chain delivery are exactly what disruptors in FinTech are targeting. Viewing the definition, delivery and management of financial products and services as part of a cradle-to-grave supply chain allows for not only efficiencies in creation and data gathering, but also in discovery, disclosures, tracking and retirement.

- A Greek derivation, a polymath is an individual whose knowledge spans a significant number of subjects, known to draw on complex bodies of knowledge to solve specific problems.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA Insights welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)