BREAKING NEWS

Refis Drive Increases in MBA Weekly Survey; MBA Statement on Passage of Stimulus Bill

After marathon on-and-off negotiations, the House and Senate—and the Trump Administration—finally agreed this week on a $908 million, 5,500-page economic stimulus bill, the Consolidated Appropriations Act of 2021.

No record-low interest rates this time, but the 30-year fixed rate was low enough to attract another push of refinance applications for the second straight week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending December 18.

Low housing inventories finally caught up with November existing home sales, which fell for the first time in five months, the National Association of Realtors reported yesterday.

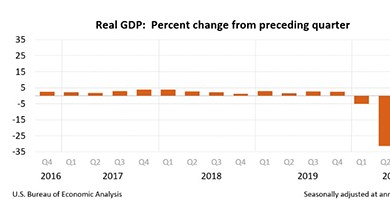

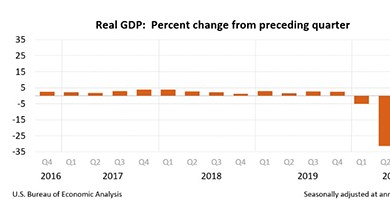

The Bureau of Economic Analysis yesterday said its third (final) estimate of third quarter gross domestic product saw real GDP increase at an annual rate of 33.4 percent. This is up slightly from the first and second estimates that took place in October and November, respectively, and reflect more complete source data.

![]()

The Conference Board, New York, said its Consumer Confidence Index declined in December, the second straight monthly decline economic uncertainty following a resurgence in the coronavirus pandemic.

The retail sector downturn started even before the pandemic and has suffered more than other property types this year. But some institutions are willing to lending on retail assets, said JLL, Chicago.

The Federal Housing Administration announced completion of its revised and streamlined loan-level certification form required from lenders when originating a single-family mortgage intended for FHA insurance endorsement.

2020 is ending…and 2021 is coming into view. A few thoughts that should be dancing around in your head…along with those sugar plums.

Chetan Patel is COO of Verity Global Solutions, San Antonio, Texas, a provider of highly crafted services spanning the mortgage loan lifecycle. He has more than 25 years of leadership experience in the mortgage industry and has been recognized as an IT All-Star by Mortgage Banking magazine.

The Mortgage Bankers Association hired mortgage industry veteran Charmaine Brown to fill its newly created position of Director of Diversity and Inclusion. Brown, who will start on Jan. 4, will be responsible for developing, promoting and advancing diversity and inclusion programs for the real estate finance industry.

Berkadia secured $65M in construction financing for multifamily assets in South Carolina and Montana.

Following one of the most volatile years in memory, the Mortgage Bankers Association's latest Mortgage Finance and Economic Forecasts seem decidedly normal.

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.