3rd Quarter GDP Balances Out

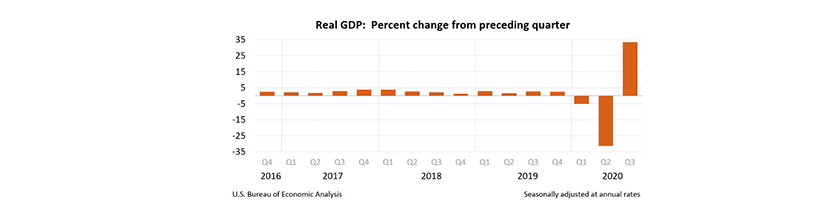

When the U.S. economy all but collapsed earlier this year in the wake of the coronavirus pandemic, economists speculated as to what kind of recovery would occur—“V”-shaped, “U-shaped, even “K-shaped” were topics of spirited discussion.

The final shape remains open; however, if the final third quarter estimate of gross domestic product provides any inkling, “V-shape” is the winner—even if only temporarily.

The Bureau of Economic Analysis yesterday said its third (final) estimate of third quarter gross domestic product saw real GDP increase at an annual rate of 33.4 percent. This is up slightly from the first and second estimates that took place in October and November, respectively, and reflect more complete source data.

At face value, the third-quarter gain canceled out the dramatic 31.4 percent drop in the third quarter. However, the coronavirus persists, with large segments of the American economy still shut down and social distancing restrictions still in place.

BEA said the upward revision primarily reflected larger increases in personal consumption expenditures and nonresidential fixed investment.

“The increase in third quarter GDP reflected continued efforts to reopen businesses and resume activities that were postponed or restricted due to COVID-19,” BEA said. “The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the third quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.”

The report said the increase in real GDP reflected increases in PCE, private inventory investment, exports, nonresidential fixed investmen, and residential fixed investment that were partly offset by decreases in federal government spending (reflecting fewer fees paid to administer the Paycheck Protection Program loans) and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

BEA said the increase in PCE reflected increases in services (led by health care as well as food services and accommodations) and goods (led by clothing and footwear as well as motor vehicles and parts). The increase in private inventory investment primarily reflected an increase in retail trade (led by motor vehicle dealers). The increase in exports primarily reflected an increase in goods (led by automotive vehicles, engines, and parts as well as capital goods). The increase in nonresidential fixed investment primarily reflected an increase in equipment (led by transportation equipment). The increase in residential fixed investment primarily reflected an increase in brokers’ commissions and other ownership transfer costs.