BREAKING NEWS

MBA: Share of Loans in Forbearance Rise to 5.54%; Applications Drop in MBA Weekly Survey

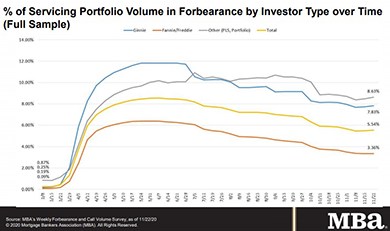

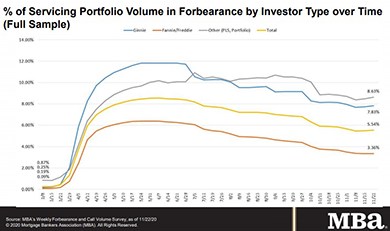

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

Despite sustained record-low interest rates, mortgage applications dipped slightly during the holiday-shortened Thanksgiving week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 27.

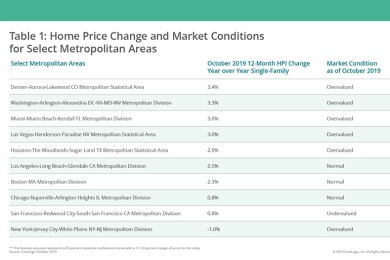

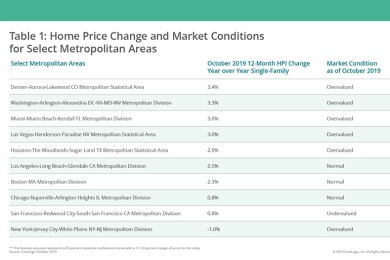

CoreLogic, Irvine, Calif., said home prices increased by 7.3% in October from a year ago, marking the fastest annual appreciation since April 2014.

“Sluggish” commercial real estate investment activity caused loan closings to slow in the third quarter, reported CBRE, Los Angeles.

Looking to work with an AMC partner? Here are some areas to consider as you make your choice.

The Mortgage Bankers Association announced it combined all of its signature spring conferences into a single Spring Conference & Expo, taking place via MBA LIVE from Apr. 20-22.

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers, and investors?

KBRA just released its 2021 Sector Outlook: CMBS: Slow and Steady report. As the real estate finance industry grapples with increased infection rates approaching the holiday season and how to think about 2021, MBA NewsLink sat down with KBRA’s Patrick McQuinn and Sacheen Shah to get their insights.

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.

Phillips Realty Capital, Bethesda, Md., originated a $141.7 million bridge loan to recapitalize The Sur, a recently delivered 360-unit apartment community near Amazon’s HQ2 in Arlington, Va.

Fitch Ratings, Chicago, said while the ongoing coronavirus pandemic has negatively impacted the broader economy, the title insurance industry remains positioned for favorable margins with positive housing and mortgage market fundamentals heading into 2021.

The Mortgage Bankers Association and a broad coalition of financial services stakeholders recently launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.