MBA: November New Home Purchase Mortgage Applications Fall by 16% Monthly; Up Nearly 35% from Year Ago

The Mortgage Bankers Association’s Builder Application Survey data for November show mortgage applications for new home purchases fell by 16 percent from October but jumped by 34.7 percent from a year ago.

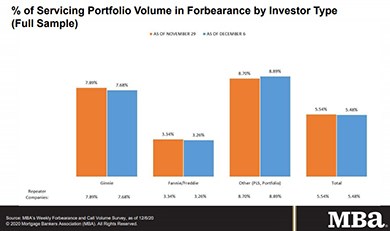

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

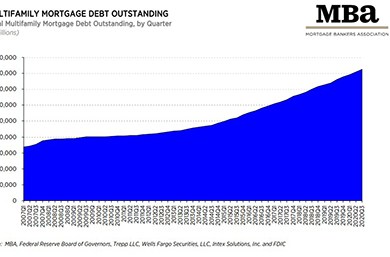

MBA: 3Q Commercial/Multifamily Mortgage Debt Up 1.5%

Commercial/multifamily mortgage debt outstanding rose by $57.0 billion (1.5 percent) in the third quarter, the Mortgage Bankers Association reported this morning.

FHA Technology Initiatives Begin Bearing Fruit

A partnership between the HUD’ Office of the Chief Information Officer and HUD’s Federal Housing Commissioner, FHA Catalyst is a secure, flexible, cloud-based platform that provides a modern, automated system for lenders, servicers and other FHA program participants.

MBA, Trade Groups Urge Treasury to Promote ‘Critical Reforms’ of GSEs

More than 12 years after the federal government placed Fannie Mae and Freddie Mac under conservatorship—and seemingly no closer to moving them out of conservatorship—the Mortgage Bankers Association and several industry trade groups urged the Treasury Department to promote “critical reforms” of the GSEs and bolster their safety and soundness.