ANNOUNCEMENT

The MBA Forbearance & Call Center Survey will be released today at 4:00 p.m. ET; the delay resulted from the Thanksgiving holidays.

October pending home sales fell for the second straight month but continued to run well ahead of its pace from a year ago, the National Association of Realtors reported yesterday.

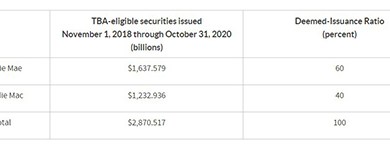

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.

JLL, Chicago, said global real estate investment improved in the third quarter, but COVID-19 uncertainty continues to hamper markets.

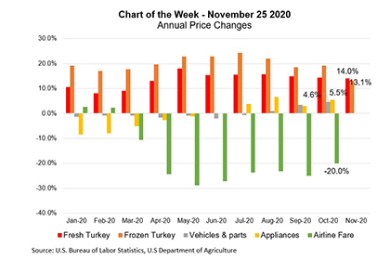

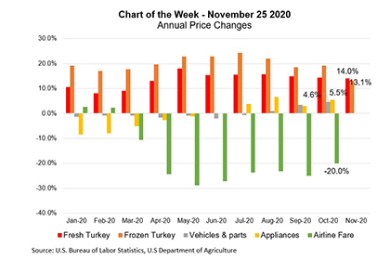

Our Thanksgiving-themed Chart of the Week highlights the strength in turkey price growth in 2020, along with year-over-year price changes for a few other goods categories.

Looking to work with an AMC partner? Here are some areas to consider as you make your choice.

KBRA just released its 2021 Sector Outlook: CMBS: Slow and Steady report. As the real estate finance industry grapples with increased infection rates approaching the holiday season and how to think about 2021, MBA NewsLink sat down with KBRA’s Patrick McQuinn and Sacheen Shah to get their insights.

The Mortgage Bankers Association announced members of its Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) for 2021.

Is your company flying blind with incomplete or incomparable data to support key business decisions? Consider joining an elite group of 100+ lenders this spring that participate in the MBA and STRATMOR Peer Group Roundtables (PGR).

Fitch Ratings, Chicago, said while the ongoing coronavirus pandemic has negatively impacted the broader economy, the title insurance industry remains positioned for favorable margins with positive housing and mortgage market fundamentals heading into 2021.

Axiom Capital Corp. Montclair, N.J., arranged $25.3 million in financing for two New York retail assets.

Freddie Mac’s K series quietly holds a place as an important, innovative multifamily market solution that has served borrowers, lenders, tenants and bondholders extremely well since its inception. Importantly for a government-sponsored entity, it also serves as a mechanism to transfer risk away from taxpayers.

As we investigate 2021, one thing is certain, technology will be the innovation mantra pushing mortgage bankers and their high-touch processes into realities such as straight-through processing. These advanced technical innovations will challenge FSBO’s to think very, very differently.