BREAKING NEWS

CFPB Issues Final QM Rules; MBA Provides Analysis

The Consumer Financial Protection Bureau on Thursday issued final rules related to qualified mortgage loans. The Mortgage Bankers Association provided preliminary summaries of the final rules.

![]()

President-Elect Joseph Biden this week nominated Rep. Marcia L. Fudge, D-Ohio, as HUD Secretary. If confirmed, she would be the first woman to lead HUD in more than 40 years and the second Black woman in history to lead the Department.

The MBA Mortgage Action Alliance announced results of its Steering Committee elections, adding three at-large members for the 2021-2022 election cycle.

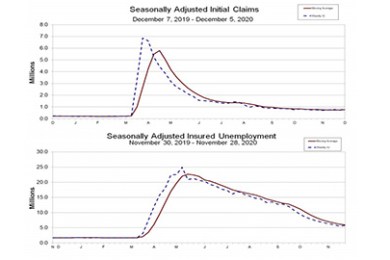

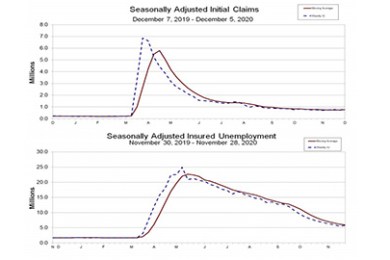

Initial claims for unemployment insurance rose for the third time in five weeks amid signs the economy is stalling, the Labor Department reported yesterday.

The Federal Housing Finance Agency on Thursday announced Fannie Mae and Freddie Mac would extend several loan origination flexibilities until January 31, from Dec. 31.

As the CARES Act has been welcome relief to borrowers, many servicers are finding their own relief in strategic partnerships.

Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4.

The MBA Opens Doors Foundation announced two real estate finance industry executives to its Board of Directors: Kristy Fercho, 2021 MBA Chair-Elect, and Executive Vice President and Head of Wells Fargo Home Lending; and Matt Rocco, 2021 MBA Vice Chairman, and Chairman of the Board and CEO of Grandbridge Real Estate Capital.

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year

Greg Holmes is Managing Partner with Credit Plus Inc., Salisbury, Md., a third-party verifications company serving the mortgage industry.

Institutional Property Advisors, Ontario, Calif., brokered $42.4 million in retail property sales in Indiana, Michigan and Florida.

Distribution of wealth among U.S. households became increasingly unequal from 2007 through 2016 as a decline in homeownership and home values impacted the wealth of middle-class families, according to a new research report, The Distribution of Wealth Since the Great Recession, released yesterday by the Mortgage Bankers Association's Research Institute for Housing America.

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released today by the Mortgage Bankers Association.