BREAKING NEWS

Applications Drop 3.3% in MBA Weekly Survey

Mortgage interest rates jumped back over 3 percent last week, resulting in a decrease in mortgage refinance applications, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 14.

Housing starts posted double-digit increases for the second straight month, HUD and the Census Bureau reported yesterday, to its highest level since February.

![]()

The Consumer Financial Protection Bureau yesterday issued a notice of proposed rulemaking to create a new category of seasoned qualified mortgages, called “Seasoned QMs,” to “encourage innovation and help ensure access to responsible, affordable in the mortgage credit market.”

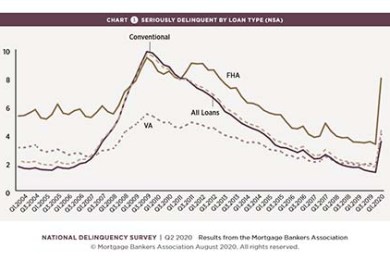

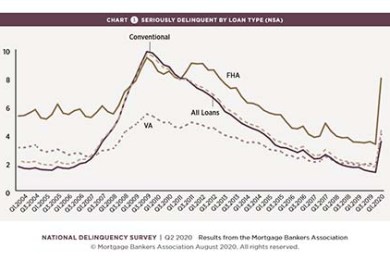

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

For our 2020 Consumer Lending Survey eBook, we dive deep into the minds of consumers in the market for a loan in this socially distanced COVID-19 environment.

CoreLogic, Irvine, Calif., said single-family rent growth reached its slowest rate in a decade during June amid elevated unemployment rates.

Taken together, the analysis from industry thought leaders indicates that CMBS will continue to have challenges with existing loans through 2021 as new issuance remains robust for agency MBS and at a tepid pace for conduit transactions. Challenges with maturing loans are starting as well; however, 2022 will bring a major wave of those loans.

As consumers make efforts to significantly limit in-person interaction, the demand for remote online notarization eClosings, which allow borrowers to join real estate closings from the comfort of and, more importantly, safety of their homes, has increased exponentially. This begs the question: Why isn’t everyone closing every loan with RON?

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown's Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

The leverage of all things digital is here. However, digitalization is NOT digital transformation, let alone digital leverage. As finance firms and their target markets reach their cycle peaks, the leverage of digital is a requirement most banking leaders have not incorporated into their forthcoming budgets and operations.

Freedom Mortgage Corp., Mount Laurel, N.J., and RoundPoint Mortgage Servicing Corp., Charlotte, N.C. completed their previously announced merger. RoundPoint is now a wholly owned subsidiary of Freedom Mortgage, a full-service mortgage company and provider of VA and government-insured lending.

Axiom Capital Corp., Montclair, N.J., arranged $43 million to refinance industrial properties in Summerville, S.C. and Saddle Brook, N.J.