MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

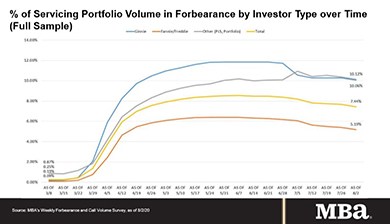

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.

MBA, Trade Groups Ask CFPB to Extend Comment Period on ECOA Request for Information

The Mortgage Bankers Association and nearly a dozen industry trade organizations yesterday asked the Consumer Financial Protection Bureau to extend the comment period on its Request for Information on expanding access to credit through Regulation B, which implements the Equal Credit Opportunity Act.

Bidding Wars Hold Steady in July—More than Half See Competition

Redfin, Seattle, said 54% of its home offers faced bidding wars last month amid record-low mortgage rates and an acute shortage of homes for sale. This marks the third month in a row where more than half of Redfin home offers faced competition.

MBA Chart of the Week: Processing Times for HELOCs, Home Equity Loans

This week’s MBA Chart of the Week drills down on the U.S. Bureau of Economic Analysis’ advance estimate of real gross domestic product for the second quarter, which was released July 30.