MBA Chart of the Week: Processing Times in Days for HELOCs and Home Equity Loans

In MBA’s newly released Home Equity Lending Study on lending and servicing of open-ended home equity lines of credit (HELOCs) and closed-end home equity loans (HE Loans), operational metrics such as turn times are tracked to understand efficiencies relative to peers and other credit products.

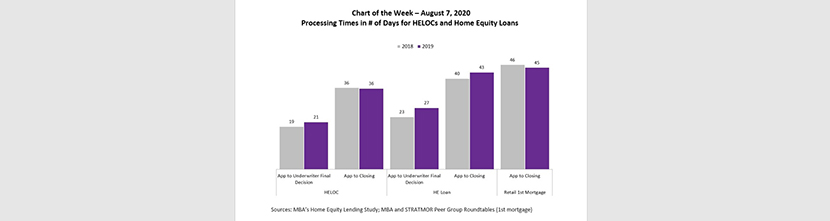

In this week’s chart, we compare the processing times in number of days for HELOCs, HE Loans, and first mortgages. Processing times were lower for HELOCs compared to HE Loans. In 2019, the number of days from application to underwriter final decision was 21 days for HELOCs compared to 27 days for HE Loans. The number of days from application to closing for HELOCs was 36 days versus 43 days for HE Loans. Both HELOCs and HE Loans had lower processing times from application to closing than the typical first mortgage, which averaged 45 days.

However, between 2018 and 2019, turn times for HELOCs and HE Loans increased–or stayed the same–with no apparent improvement. Participating HELOC and home equity lenders cited digital enhancements–new front-end systems to improve the customer experience, automated underwriting, robotics and eClosings–as ways to improve turn times and keep their products competitive in the coming years.

–Marina Walsh mwalsh@mba.org ; Jon Penniman jpenniman@mba.org.