MBA Mortgage Action Alliance ‘Call to Action’ Targets GSE Refi Fee

In the wake of new directive by Fannie Mae and Freddie Mac to impose a 50 basis point “Adverse Market Refinance Fee” on most refinance mortgages, effective Sept. 1, the Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ urging its 50,000 members to contact their members of Congress and the Federal Housing Finance Agency to roll back the directive.

MBA, Trade Groups Issue Joint Statement on GSE Adverse Market Fee

The Mortgage Bankers Association yesterday joined a broad coalition of organizations representing the housing, financial services industries as well as public interest groups issued the following statement on the GSEs’ new adverse market fee.

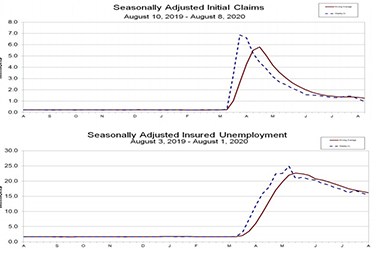

Initial Claims Fall Under 1 Million, Remain Historically Elevated

For the first time since the economic effects of the coronavirus took hold, new applications for unemployment fell below one million, although they remain elevated by historic standards.

Housing Market Roundup Aug. 14, 2020

Here’s a quick-hit summary of housing market headlines this week, featuring reports from Redfin; Bankrate.com; Black Knight; and Fitch Ratings.

MBA: July New Home Purchase Mortgage Applications Up 1% from June, 39% from Year Ago

The Mortgage Bankers Association this morning released its July Builder Applications Survey, reporting mortgage applications for new home purchases increased by 39 percent from a year ago and by 1 percent from June.