BREAKING NEWS

Applications Up 15% in MBA Weekly Survey

Mortgage application activity entered March like a lamb, but, thanks to falling interest rates, came out like a lion.

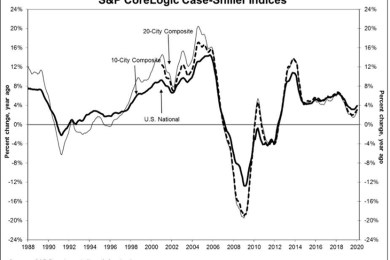

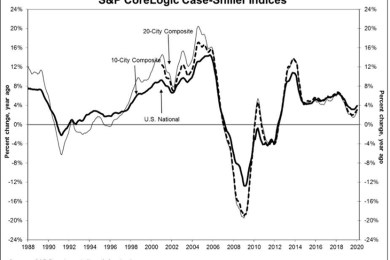

S&P Dow Jones Indices, New York, said home prices continue to increase at a modest rate across the U.S. to start the first quarter.

![]()

The Conference Board, New York, reported its Consumer Confidence Index declined sharply in March, as consumers’ short-term outlook all but collapsed.

Seniors are being especially hard hit by the health and economic impacts of the COVID-19 pandemic. However, homeowners are not entirely at the mercy of a fickle financial market. There are tools available to help retirees limit their sequence risk. One of the more effective being the Home Equity Conversion Mortgage.

On the website of Clarifire, a Software-as-a-Service company specializing in workflow automation in multiple industries, particularly mortgage servicing, the company declares its vision: “To transform chaos into clarity.”

Howard Botts could be in Los Angeles and tell you within 15 minutes of a tornado touching down in the Midwest, if any, properties sustained damage and the severity of the damage. He’s not psychic; he’s scientific.

Like many homebuyers, Julie Felts and her husband did not have a positive experience at the closing table. With mounds of paperwork and a seller in tears sitting just across from them, the close was nightmarishly long, inconvenient, stressful and emotionally draining. “I just remember thinking there should be a better way to do this; we shouldn’t have to be in the same place at the same time,” she says.

MBA hosted a webinar on Friday, March 27 with commercial real estate finance industry leaders to discuss COVID-19’s impacts on the industry.