Mark Dangelo: Are Bankers Necessary? Part 3

Mark P. Dangelo is president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of four innovation books and numerous articles. Mark is a strategic management consultant, operations advisor and leadership specialist with extensive process, technology, and financial experience, and he is a frequent contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402

On April 14, JPMorgan CEO @JamieDimon indicated his operations were preparing for a “severe recession.” To state that the economic conditions we are living in are precarious and uncertain is almost meaningless. For most living today, we are in unchartered territory.

During the past two decades, banking functions have been adapting. In 2001, there was a demand for security that transformed disclosures and reporting. In 2008, a transformational crisis brought on by misapplication of banking risks brought the world into the Great Recession and a post-era of Dodd-Frank. In 2020, it is a pandemic virus altering global industries, supply chains and consumer interactions—what follows will be a “next normal” promising a post Great Depression rewriting of commerce. It will lead many consumers, businesses, politicians and pundits to ask, “Are Bankers Necessary?”

As we have learned, nature and business abhor a void, so when one is created, people, technology and processes rush in to fill it up. The voids created by social distancing, lockdowns and downstream implications are realities for financial services and banking organizations.

A Gaggle of Harm

Across the #FSBOs, there has been a decade to forecast and prepare for the impact to earnings (Q1 2020 profit declines >40%), the souring of household debt (and now forbearance), the poor quality (< #BBB rated) of corporate bonds, which over the last decade ballooned to over $16 trillion—but did anyone anticipate that the fall from success would take place in weeks?

Moreover, the Federal Reserve was buying $100 billion per month of U.S. debt that at the height of the Great Recession—today, it buys that much in four days. And, by Q3 2020, the federal government will have run over a $4 trillion annual deficit, not only breaking historic levels, but for the first time since 1946, surpassing the annual GDP by more than 110%. For banks and their valuable functions in social constructs, unemployment has in under a month reached 22 million—now at climbing percentages and breadth not seen since the Great Depression.

Yet, against all the pain and possibilities, there has been a solidarity that we are all in it together fighting the same cause. However, that cohesion as witnessed by bipartisan congressional votes, is waning as consumers clamor for normal lives and the spotlight of who to blame has begun in earnest. It is a time for new pandemic realities as the downstream consequences of loan forbearance, unrestricted consumer and sovereign credit expansion, and contractual non-payments breaches (e.g., the rent collection at 15% to 20% of the $20 billion monthly commercial collection obligations) begins to expose the ramifications of political policies across complex economic exchanges. At this point, we’re just not sure which consumer, government, political party, or banking institution will be left holding the check in this made for television horror drama.

In the middle of all this are bankers, who by their market functionality, have brokered loans, established covenants, defined risk, hedged positions, guaranteed firestops, issued lines-of-credit and generally profited from the decade of “new” finance born from the ashes of the Great Recession. Consumers are already pointing out the decade of record profits and outsized executive compensation packages as they panic over their lack of incomes and loan repayment options. And, if that was not enough to stoke FSBO fears, there are many other drivers now gaining momentum as highlighted in the panel below.

If the implications of non-payments, defaults and consumer confidence expands, will bankers now need a huge bailout to stymie the likely financial chaos created by the original crisis and subsequential interconnected products and services? Will central bankers, with FSBO living wills in hand, now be forced to execute the unthinkable? What will bankers do when the ire of political forces, as already evident, advocate, lobby and promote alternatives to the once stoic and regulated markets? Global, cross-industry examples are emerging in education, social safety, airlines, healthcare, distribution and retail. Therefore, as economic turmoil is emerging across market segments and their verticals, it must be asked again, “Are Bankers Necessary?”

It’s Not an Abberation

Now that we’re into Part 3 of this series, I hope you have not taken my questions and intent as suggesting that bankers should close up shop and liquidate holdings as they are too rigid, too “regulatory-focused,” or too culturally limited? It may be true that for some institutions the tradition of banking will lead them into mergers, transitions and even fire-sale liquidations, but 2020 will be the watershed year that will comprehensively transform banking—and their personnel—permanently.

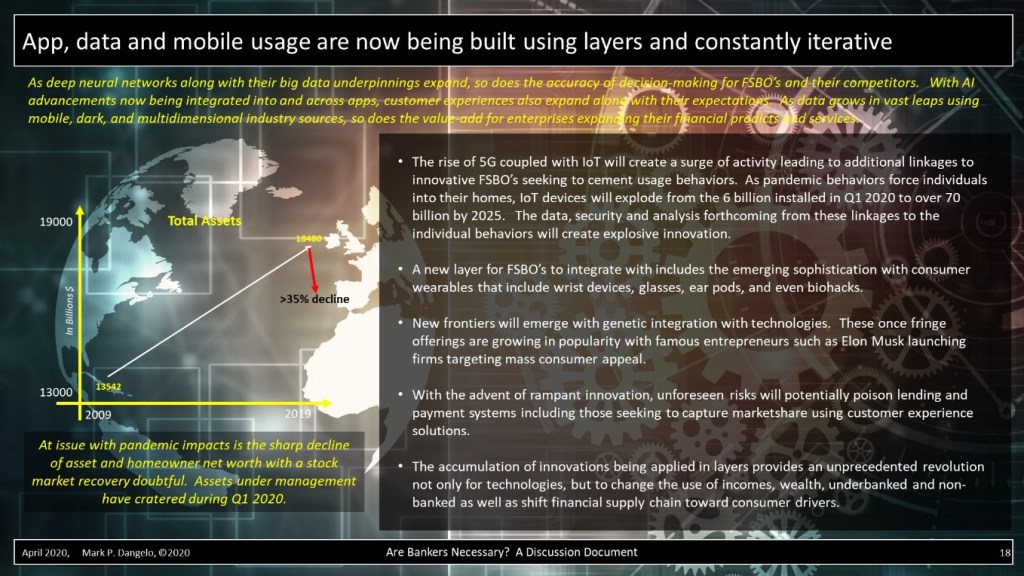

Moving further out of the comfort zones, as banking as a service (#BaaS) expands by means of fintech advancements and consumer preferences, I wonder how many strategic FSBO leaders are contemplating “edge-banking”—analogous to edge computing—partnership driven, digital and distributive, virtual and transformative? As #IoT, innovations, and #AI (i.e., synthetic intelligence) expands as part of the fourth industrial revolution (#4IR), will bankers accept the compartmentalization and orchestration of their functions or cling to regulatory mindsets that they must be “in control?” t is likely that this decade will internalize orchestration and layered innovation redeployments of cross-industry advancements for new and relevant FSBO innovations. FSBOs must move beyond the technology traps and into the relinquishment of commoditized offerings driven by intelligent solutions.

We can see in the following visual that the premises for banking are evolving. We can cling to the hope that with time, a return of “normal” will be achieved if we roll with the markets and do not resist more oversight. We can anticipate that any new catalysts (e.g., a second wave of pandemic) might not be “as bad”, impact the economy “as much”, or delay innovative advancements “as broad” as what might be—it is highly unlikely that the rationale and implications already experienced by FSBOs can now be put back into Pandora’s bankers box.

It now appears highly probable that for FSBOs and their bankers to retain relevancy, they will increasingly be required to provide clear and concise offerings, identify impacts to traditional solutions, define value-add of consumer behaviors, while continuously iterating, communicating, and redeploying. In short, the entire financial supply chains will require permanent rework and alternative provisioning all the while using iterations to adapt to rapidly emerging social demands and politics.

The pandemic, and it anticipated resurgence, will quickly force significant losses onto FSBO’s and their investors without the luxury of consumers having ample time to recover from their economic trials. The voices asking, “Are Bankers Necessary?” will turn into choir and then to Burning Man as the positions taken by bankers jeopardize banking functions and institutions. Yet, who will have the sovereign facilities left to secure rescues post-first wave pandemic—when country IOUs no longer curry favorable interest terms against depression era thresholds? For bankers to now bet that modern monetary theory will save their institutions is perhaps a litmus test too far, too risky, too naive?

Digital, Instant, eFactor and AI—Looking for Anything to Solve a Crisis

When unprepared for crisis management, FSBOs instinctively rush after the trends and innovations that resonate with consumers. Historically, we can look at the actions and lessons learned from the start of online banking, to social engagement, to influencer manipulation, to mobile computing, to reacting to political pressures—and discover that the initial FSBO supply chains and organizational reactions were about participating in, not leading or anticipating. These reactions over the decades are predictable as banks were regulated to be secure, trustworthy, and culturally ordinary lest they risk the safeness and soundness of domestic and international economies. And, across steady state, developed nation economies that was a good set of principles, which served central bank oversight for generations.

However, when crisis hits and new realities create aberrations within strategy execution, FSBO leaders often rush to embrace innovation as the panacea of solutions. This seems to be where we are today. FSBO communications to customers now focuses on the instant, the virtual, the augmented, the RPA and the AI to mention a scant few. The mention of “instant” innovation for the question of “Are Bankers Necessary?” is thought to be a shield against the irrelevant. Innovation is positioned as new, young, aggressive, fearless, and prized. But history has proven that instant is not always sound and staying the course is even worse. So, as FSBOs react to their market relevancy, the following panel might help their thought processes.

The Rise of Neo, the Birth of Nonbanks and the Changing Value-Equations

Any discussion on the future of FSBOs and bankers must at least recognize the rise of Neos—a new form of business, finance, interaction, social behavior and consumer. Neobanks have received significant press and even adoption targeting those consumers who want finance to fit their lives. Neobanks have taken commoditized offerings and turned them into value-added services.

Consequently, how is it possible that non-banks or banks with no physical branches can secure consumer followings and take business “away” from traditional FSBOs? The seeds for the rise of Neobanks were planted post-Great Recession, when institutions that were punished as part of their unsound lending practices, shunned the recovery markets leaving a vacuum to be filled by others. As banks turned inward, they grew greatly in asset size with the number of institutions falling and wealth concentrating. As the 4IR expanded, consumers sought choices, reduced fees, faster turnarounds, bespoke customer service, and tight integration with their daily behaviors—the FSBOs were not there and only after the markets recovered and consumers advanced, they rejoined the markets.

Neobanks did what any entrepreneur would do—developed a business model tied to opportunity and consumers and created a value-added offering(s), which resonated with buyers and channels. The following panel presents but a few of the drivers and circumstances that brought in non-traditional competition and changing the role of a banker within banking.

There is one additional thread that I need to mention. It has been a theme of consultants and management practitioners for decades and rolled out with short-term effectiveness as part of crisis responses. As layoffs and furloughs become commonplace, management teams when recovery begins use the recalls as filter to remove experienced, higher paid personnel from the employee rosters. It has been a practice to create a culturally younger enterprise with lower FTE costs—albeit sacrificing experience for dollar savings.

If FSBOs adopt once again this segment of their playbook, I would anticipate that the political fallout post-presidential election would be severe. I would anticipate that at a time of great upheaval and pain to traditional FSBO business approaches, the very skills necessary to innovate, to develop new business models, and to anticipate consumer changes will be lost. The result will be a further escalation of the commoditization and technology traps FSBO’s are now experiencing. In the end, Bill Gates was spot on when he said banking was necessary. But perhaps, amidst the current catalysts and turmoil, we can affirmatively answer the question moving forward, with rigor, discipline and innovation, that bankers themselves are also necessary. In short, bankers need to move beyond the technology traps.

In Conclusion

As we reach the end of this series, the topics and challenges covered are numerous. So, what should bankers do—what is the prescription? Afterall, management consultants provide prescriptions, our doctors write prescriptions, and our consumers are conditioned to prescriptions—tell me what to do!

There is a famous Latin saying, from the Bible Luke 4:23, that I have been known to provide the students in my graduate and undergraduate innovation programs—”Medice, cura te ipsum.” Within the panels, across the article texts, we have discovered what the value of innovation can be, and the likely directions that strategically and tactically need to be undertaken all tailored to YOUR institution, your circumstances, and your ability to execute. As shown in the following diagram, there are several themes that will be applicable.

“Are Bankers Necessary?” is about finding out the cure, which unlike a medical ailment (e.g., #COVID-19), one pill, one vaccine, one treatment will not fix the core challenges. In the end, bankers must internalize Medice, cura te ipsum, which when translated, is a very recognized saying–“physician heal thyself.”

Bankers, perhaps it is time as a result of this pandemic catalyst to make the changes that have been repeatedly reoccurring, but which are difficult when the FSBO is profitable? With tens of billions quickly being set aside in the last 30 days to cover loan losses, business-as-usual has ended. Bankers need to find an innovation relevancy—rather than assume they have a role in the future of banking. Indeed, in this environment, nothing is for certain except for banking.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)