1st Quarter GDP Takes a Hit—And It Will Probably Get Worse

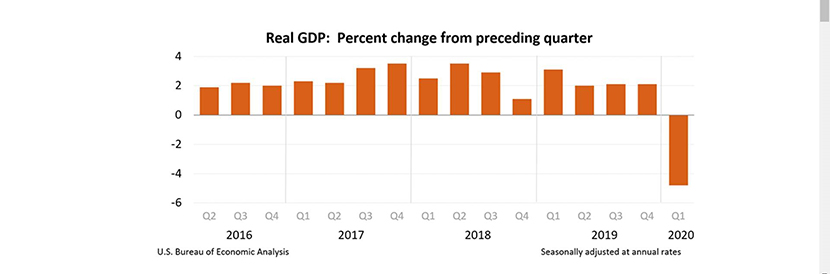

The Bureau of Economic Analysis yesterday reported its first (advance) estimate of first quarter gross domestic product saw the U.S. economy contract by nearly 5 percent as the effects of the coronavirus pandemic kicked in.

The report said real GDP decreased at an annual rate of 4.8 percent in the first quarter. By comparison, in the fourth quarter, real GDP increased 2.1 percent. BEA said the decline in first quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued “stay-at-home” orders in March.

“This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations and consumers canceled, restricted or redirected their spending,” BEA said. “The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.”

The report said the decrease in real GDP in the first quarter reflected negative contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and private inventory investment, partly offset by positive contributions from residential fixed investment, federal government spending and state and local government spending. Imports, a subtraction in the calculation of GDP, decreased.

“The decline in GDP in the first quarter really reflects the sudden stop of economic activity in March,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “We expect an even steeper decline in the second quarter, as the country has been in lockdown in April. However, as indicated in our purchase application data out this morning, we are beginning to see an uptick in the pace of housing demand, which coincides with re-openings in parts of the country.”

“Surprisingly,” Fratantoni noted, the report includes an increase in residential investment, “which does not line up with the strong decline in home sales and construction at the end of the quarter.”

Jay Bryson, Acting Chief Economist with Wells Fargo Securities, Charlotte, N.C., said the decline in first quarter GDP provides “just a hint” at what’s to come in the second quarter. “To put the swoon in services spending in Q1 into perspective, consider that the next steepest rate of decline was the 3.0% drop that occurred in all the way back in Q4-1953,” he said.

Bryson noted most of the economy was open through mid-March. “The lockdown of the economy, which occurred in most states, did not really start to take effect until mid-March/early April,” he said. “We look for real GDP to contract at an unprecedented annualized rate in excess of 20% in Q2-2020. Furthermore, we expect that the unemployment rate will surge to more than 15% in April or May. But the federal government along with the Federal Reserve has put numerous support mechanisms in place. These programs should help to ensure that the economy does not completely collapse while stay-at-home orders are in place. As states slowly start to re-open in coming weeks and months, and assuming that the COVID-19 outbreak does not come roaring back, the economy should start a process of gradual recovery in the third quarter.”

BEA said current‑dollar GDP decreased by 3.5 percent, or $191.2 billion, in the first quarter to $21.54 trillion. In the fourth quarter, GDP increased 3.5 percent, or $186.6 billion.