Mortgage Applications Back Up in MBA Weekly Survey

Mortgage application activity entered March like a lamb, but, thanks to falling interest rates, came out like a lion.

Mortgage applications, led by a surge in refinancings, increased by 15.3 percent from one week earlier, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending March 27.

The Market Composite Index increased by 15.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased by 15 percent compared to the previous week.

The unadjusted Refinance Index increased by 26 percent from the previous week and was 168 percent higher than the same week one year ago. The refinance share of mortgage activity increased to 75.9 percent of total applications from 69.3 percent the previous week.

The seasonally adjusted Purchase Index decreased by 11 percent from one week earlier. The unadjusted Purchase Index decreased by 10 percent compared to the previous week and was 24 percent lower than the same week one year ago.

The FHA share of total applications increased to 9.1 percent from 8.4 percent the week prior. The VA share of total applications remained unchanged from 12.5 percent the week prior. The USDA share of total applications remained unchanged from 0.4 percent the week prior.

“Mortgage rates and applications continue to experience significant volatility from the economic and financial market uncertainty caused by the coronavirus crisis,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “After two weeks of sizeable increases, mortgage rates dropped back to the lowest level in MBA’s survey, which in turn led to a 25 percent jump in refinance applications.”

Kan said the bleaker economic outlook, along with the first wave of realized job losses reported in last week’s unemployment claims numbers, likely caused potential homebuyers to pull back. “Purchase applications were down over 10 percent, and after double-digit annual growth to start 2020, activity has fallen off last year’s pace for two straight weeks,” he said. “Buyer and seller traffic – and ultimately home purchases – will also likely be slowed this spring by the restrictions ordered in several states on in-person activities.”

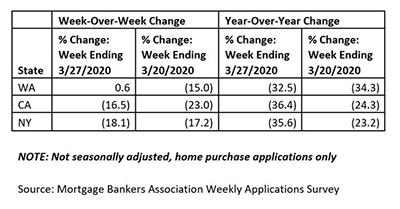

Looking at the impact at the state level, here are results showing the non-seasonally adjusted, week over week percent change in the number of purchase applications from Washington, California and New York.

MBA reported the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.47 percent from 3.82 percent, with points decreasing to 0.33 from 0.35 (including origination fee) for 80 percent loan-to-value ratio loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400) remained unchanged at 3.84 percent, with points decreasing to 0.31 from 0.35 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by FHA decreased to 3.57 percent from 3.69 percent, with points decreasing to 0.28 from 0.43 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.05 percent from 3.28 percent, with points decreasing to 0.27 from 0.38 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 adjustable-rate mortgages decreased to 3.35 percent from 3.38 percent, with points decreasing to -0.03 from 0.26 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The ARM share of activity decreased to 3.2 percent of total applications.

The survey covers more than 75 percent of all U.S. retail and consumer direct residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts.