Joe Langner: HECMs Shield Seniors from Investment Sequence Risk in Turbulent Times

Joe Langner is president of ReverseVision, San Diego. He has 30 years’ senior leadership experience driving growth at marquis mortgage technology and software companies. A former executive vice president and chief sales officer withEllie Mae, Langner executed the firm’s initial public offering in 2011. Most recently, Langner served as CEO of Blue Sage, and previously served as president of PCLender, EVP and general manager of Sage and SVP with Dun and Bradstreet.

Seniors are being especially hard hit by the health and economic impacts of the COVID-19 pandemic. Compounding worries of being among the population’s most vulnerable to the disease is the prospect of premature retirement portfolio depletion due to sequence of returns risk (sequence risk) in a volatile market.

In layman’s terms, sequence risk occurs when retirees incur significant negative investment returns early in retirement. Two people who begin retirement with the same savings can encounter different financial outcomes depending on the sequence of returns they experience — even if they earn the same average return over the course of retirement. Clearly, the timing of financial market volatility can have a major impact on retirement resources.

However, homeowners are not entirely at the mercy of a fickle financial market. There are tools available to help retirees limit their sequence risk. One of the more effective being the Home Equity Conversion Mortgage (HECM).

Enter the HECM

For the uninitiated, a HECM is a HUD-insured reverse mortgage the terms of which can be structured with a fixed or an adjustable rate. Homeowners with adjustable-rate HECMs may choose to receive a line of credit (LOC) with payouts disbursed in one-time, monthly or annual draws.

A HECM LOC may be the ideal alternative for senior homeowners who want to extend the life of their investment portfolios. A 2012 study by Salter, Pfeiffer and Evensky found that homeowners entering retirement with both home equity and a retirement savings nest egg could improve the “survival rate” of their savings over a 30-year horizon by as much as 85% using a HECM LOC to reduce sequence risk.

By drawing on the HECM line of credit instead of tapping 401(k) savings or other investment accounts whenever financial markets are down, borrowers can significantly improve their retirement income and estate value at end of life.

HECM LOC in Action

Consider a scenario in which Mary, a 67-year-old retiree whose retirement portfolio was recently reduced by market volatility. With current portfolio assets of $175,000, Mary needs to adjust her budget to ensure she can continue to receive $1,750 income a month for the next 20 years.

Mary knows it is highly unlikely that her needs can be met through her retirement portfolio alone. However, she has another significant asset she can leverage: her home equity. Mary consults with her lender on all options in leveraging equity, which are as follows:

- Refinance with a standard mortgage, withdrawing all equity;

- Secure a HELOC; or

- Take out a HECM

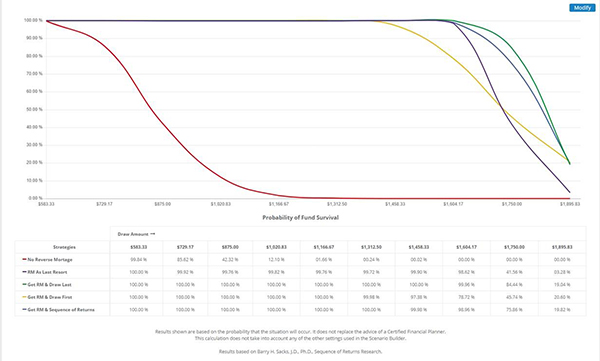

Of these options, Mary learns that only the HECM is uniquely structured to serve a homeowner’s long-term retirement income needs, with certain benefits specific to individuals whose investment income has declined due to market fluctuations. With a HECM, her financial planner can run multiple scenarios through a combined financial planning and equity software to help model the likelihood that Mary’s retirement income can be sustained for another 20 years. Mary learns that if she continues to draw $1,750 a month from her retirement portfolios:

- Without a HECM LOC, there is a zero percent chance her funds will last

- If a HECM LOC is taken only after Mary’s investment funds are exhausted, there is a 42 percent chance her funds will last

- If a HECM LOC is taken immediately, but only drawn when the market is down, there is a 76 percent chance her funds will last

- A HECM LOC is taken immediately, but drawn only after Mary’s funds are exhausted, there is an 84 percent chance her funds will last

- A HECM LOC is taken immediately, but equity is exhausted before retirement portfolio funds are tapped, there is a 46 percent chance her funds will last

The above model was created with ReverseVision’s Scenario Builder. Calculations are based on an annual HECM expected rate (ER) of 4.970 percent and two percent inflation. ReverseVision Scenario Builder algorithms are based on Barry H. Sacks, J.D., Ph.D., sequence of returns research.

The findings are clear. If Mary wishes to maintain her current lifestyle in retirement and protect her investment portfolio as advised by her financial planner, initiating a HECM LOC as soon as possible is her best course of action. Doing so will not simply provide short-term financial relief, but also offers protection for the retirement investment portfolio. Further, since a HECM credit line typically grows, reflecting property value increases, the earlier it is put in place the greater line of credit growth will accrue. This feature makes the HECM LOC loan behave more like an additional investment than a traditional loan.

By replacing investment income during worrisome times, drawing on a HECM LOC both solves an immediate source of worry for Mary and sets her up for an improved position should the market rebound as most financial planners anticipate.

Help Your Community and Your Business

The HECM gives lenders a unique opportunity to help a part of the population most affected by pandemic-related market conditions preserve their hard-earned retirement funds. Further, lenders only strengthen their business by offering flexible lending products suited to weather even the toughest economic storm. It is in everyone’s best interest to make sure borrowers age 62 years and older are aware of this home equity option.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)