Mortgage Applications Down in MBA Weekly Survey

Mortgage application activity took a hit last week as the housing market continued to struggle with the effects of the coronavirus pandemic, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending April 3.

The Market Composite Index decreased by 17.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased by 18 percent compared to the previous week.

The unadjusted Refinance Index decreased by 19 percent from the previous week and was 144 percent higher than the same week one year ago. The refinance share of mortgage activity decreased to 74.2 percent of total applications from 75.9 percent the previous week.

The seasonally adjusted Purchase Index decreased by 12 percent from one week earlier. The unadjusted Purchase Index decreased by 12 percent compared to the previous week and was 33 percent lower than the same week one year ago.

The FHA share of total applications increased to 10.6 percent from 9.1 percent the week prior. The VA share of total applications increased to 14.3 percent from 12.5 percent the week prior. The USDA share of total applications remained unchanged from 0.4 percent the week prior.

“Mortgage applications fell last week, as economic weakness and the surge in unemployment continues to weigh heavily on the housing market,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Purchase activity declined again, with the index dropping to its lowest level since 2015 and now down 33 percent compared to a year ago. With much less liquidity and tighter credit in the jumbo market, average loan sizes declined, and mortgage rates for jumbo loans increased to a high last seen in January.”

Kan noted refinance applications dropped 19 percent, reversing a 25 percent increase the week before. “Given the ongoing rate volatility, along with the persistent lack of liquidity in certain sectors of the [mortgage-backed securities] market, we expect to see continued weekly swings in refinance activity.”

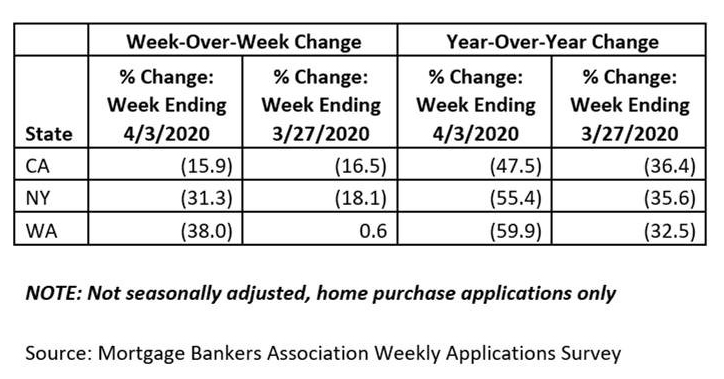

Looking at the impact at the state level, MBA reported results showing the non-seasonally adjusted, week over week percent change in the number of purchase applications from Washington, California and New York:

MBA reported the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.49 percent from 3.47 percent, with points decreasing to 0.28 from 0.33 (including origination fee) for 80 percent loan-to-value ratio loans. The effective rate remained unchanged from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400) increased to 3.87 percent from 3.84 percent, with points decreasing to 0.26 from 0.31 (including origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by FHA decreased to 3.54 percent from 3.57 percent, with points decreasing to 0.19 from 0.28 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.04 percent from 3.05 percent, with points decreasing to 0.25 from 0.27 (including origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 adjustable-rate mortgages increased to 3.39 percent from 3.35 percent, with points increasing to -0.02 from -0.03 (including origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The ARM share of activity increased to 3.3 percent of total applications.

The survey covers more than 75 percent of all U.S. retail and consumer direct residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts.